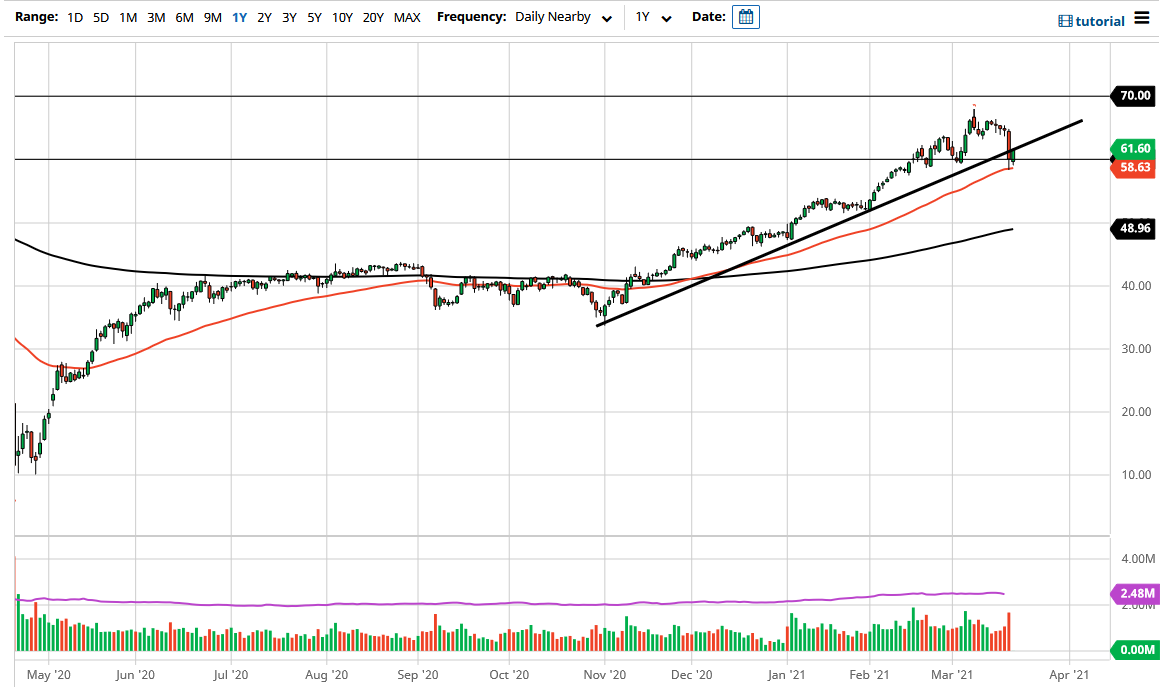

The West Texas Intermediate Crude Oil market bounced a bit during the trading session on Friday to save the 50-day EMA as support. It looks as if the market is going to continue to see a lot of volatility, and the oil market has been overbought for some time. The fact that we kept above the 50-day EMA was a good sign, as the indicator is quite often followed by technical traders.

It is not a huge surprise that we did get a bit of a bounce, considering that the sell-off was drastic the day before. We gained a little over 2%, but that is not necessarily a big deal considering that the market had lost 9% the session before. We are still debating whether or not we can continue to see a move to the upside, or perhaps we are going to have gravity come back into play. The trend line was broken and that is something worth paying attention to, but the demand for crude is not going to be as strong as pricing implies.

If the US dollar continues to strengthen, and it certainly will as long as we have interest rates rising, that makes the greenback more attractive than some of its peers. Keep in mind that it takes less of those greenbacks to buy a barrel of oil as it rises, so it all kind of works hand-in-hand. OPEC has been pushing prices higher as of late due to production cuts, but that is an artificial boost surprise, because as long as there are not major players out there looking to buy oil, crude will suffer.

A headline that people have not been paying attention to is the fact that the Iranians have been sending massive amounts of crude oil to China, which undermines a lot of the idea of production cuts keeping prices elevated. I think what we have here is a scenario where the market needs to reprice a lot of the over-exuberance that we have seen. If we were to take out the losses from the Thursday session, then it is all but given that we will go to the $70 handle. If we break down below the lows of Thursday, then it is likely we go looking towards the $52.50 area underneath.