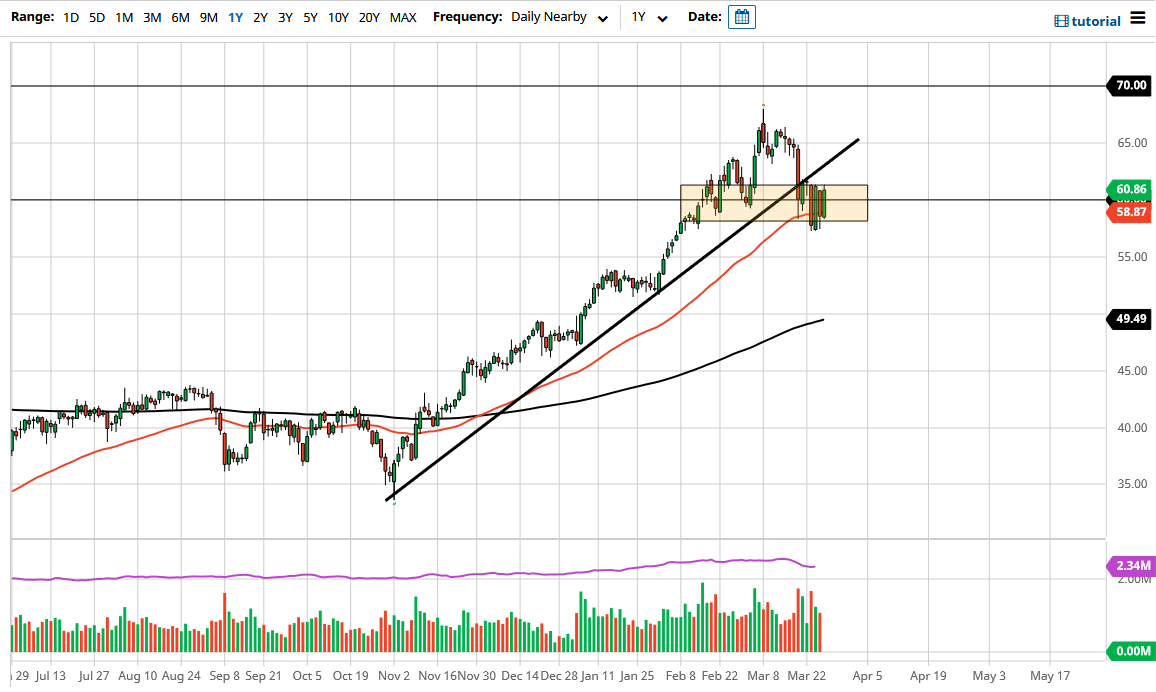

The West Texas Intermediate Crude Oil market rallied significantly during the trading session on Friday, breaking above the $60 level. The market is likely to see a lot of noise around this area as we have recently broken down below an uptrend line and are sitting right at the 50-day EMA. These both are technical areas that people will be paying close attention to, but during the day on Friday we had seen a Saudi refinery attack, so this may have been part of what we had seen jump into the market later in the day. Nonetheless, when you look at the weekly candlestick, it is a major hammer, and right at an area where you would expect to see support.

Because of this, I think if we can break above the highs from the week, then in theory it could send this market looking towards either the uptrend line, or at the $65 level. This is an area that we could be looking to grind back and forth in over the short term, in order to try and work off some of the froth. Furthermore, we could be looking at a bit of distribution because we had rallied so much.

One of the biggest problems I have with the market right now is the fact that there is a lot of questions as to whether or not we are going to have enough demand once the markets open up. After all, the European Union is starting to lock itself down again, and that certainly will not help the idea of demand. On the other hand, the United States looks as if it is strengthening rather rapidly, so that pushes in the opposite direction. With that being said, then I think we probably have a lot of “push/pull” ahead of us and that means chop.

If we do break down below the bottom of the range that we have been in this week, that would be slicing through the bottom of a hammer, and that could send this market down towards the $55 level. After that, you could be looking at a move down towards the $52.50 level, and then maybe even as low as $50. This is a market that should continue to be noisy in general, so I would be cautious about my position size.