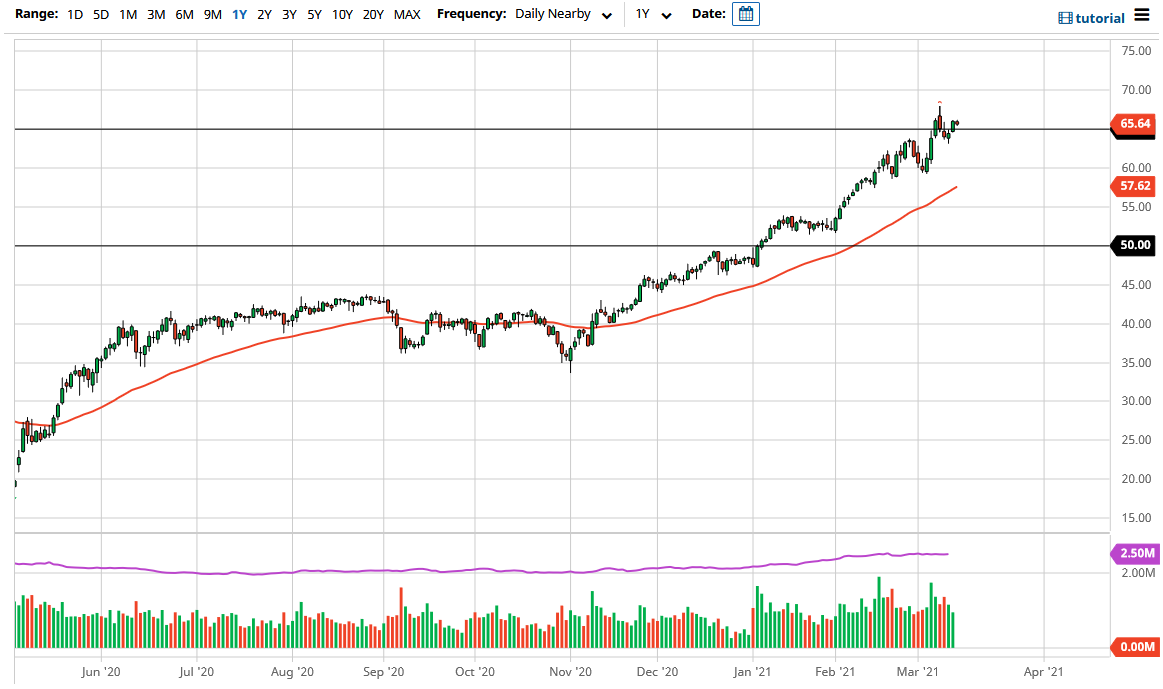

The West Texas Intermediate Crude Oil market went back and forth during the trading session on Friday and rather lackluster action. The markets in general were fairly quiet, so it should not be a huge surprise that crude oil markets behaved the same way. We are currently hovering around the $65 level, and for what it is worth you can also make an argument for some type of bullish flag in this general vicinity. However, you can also make an argument for a bit of a megaphone pattern presenting itself, which quite often can be a reversal signal because what it represents is that we are going to see increased volatility and what was previously a very straightforward uptrend. In other words, it is possible that some people are starting to have second thoughts.

I certainly am one of those people that do not believe in the energy trade, because I think that more than perfection has already been priced in. Nonetheless, you cannot step in front of this type of trend, so you need to see short-term pullbacks in order to take short-term buying position. Based upon the flag, we could go looking towards the $70 level, maybe just a bit higher than that. However, I do think that sooner or later people are going to have to focus on the fact that demand will never take out the supply in the way that the markets are trying to price that in. Furthermore, we will eventually see shale producers flood the market as well.

I do think that we are more than likely going to see a lot of choppy and short-term opportunities, so I think that this is more or less going to be a day trading opportunity presenting itself, not necessarily something that you can buy-and-hold. The bigger long-term trade has already played itself out, despite the fact that there are still a lot of questions as to whether or not we can continue to see the attitude continue. Nonetheless, I do like the idea of buying short-term trades to the upside but if we were to break down below the $63 level, I think we will go looking towards the $60 level. If we break down below there, then I think we could get a serious unwind of the uptrend that we have been in.