The violent move higher late last week within the USD/ZAR likely caused surprise for some speculators. However, if you were fortunate enough to survive the storm higher and avoid having your trading account wiped out, the upwards momentum displayed on Thursday and Friday may prove to be a welcome sight.

The USD/ZAR has enjoyed a strong long-term bearish trend and there is reason to suspect the downward track will reemerge. No, the movement might not happen easily, and it will certainly not occur overnight, but speculators who believe that last week’s surge higher was caused by a temporary shift in sentiment and that the bearish trend will resume cannot be faulted.

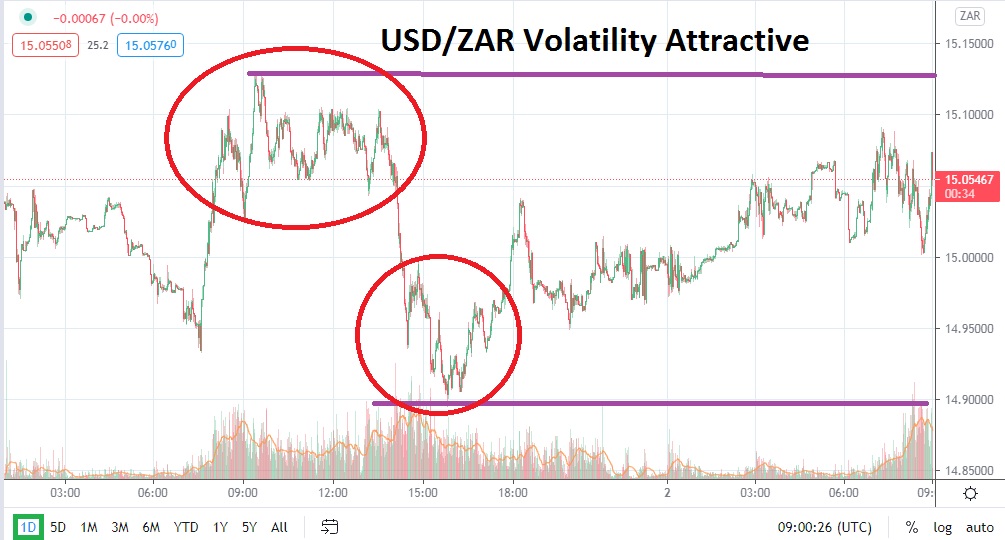

As of this writing, the USD/ZAR is lingering above the 15.00000 mark and should not escape the attention of traders of the Forex pair that this value is above the mid-term value range. The current support level of the USD/ZAR may prove vulnerable and the 15.00000 mark is a solid barometer of sentiment within Forex. Traders who sell the USD/ZAR can use fairly close resistance as stop loss ratios.

The USD/ZAR may not capture its lost ground from early last week in the blink of an eye; traders need to remain cautious and use their risk management capably. However, pursuing the long-term bearish trend of the USD/ZAR from a technical viewpoint has the look and feel of a correct speculative wager. While it is dangerous to be stubborn while trading, if a speculator pursues the USD/ZAR’s long-term trend with a consistent mode of operation until it once again finds itself in the midst of junctures near the 14.80000 domain, the endeavor could be worthwhile.

From a risk/reward perspective, the USD/ZAR appears to have limited room to traverse upwards as long as current resistance levels prove durable. While it is possible the 15.20000 juncture may face a short-term test, this location may be the place a cautious trader decides to activate their selling positions while using limit orders. Traders who are more speculative may want to wait for slight reversals which come within the proximity of the 15.12000 to 15.14000 ratios in order to sell; then again, they also might want to enter the market with a short position even more quickly.

South African Rand Short-Term Outlook:

Current Resistance: 15.15000

Current Support: 14.96000

High Target: 15.21000

Low Target: 14.84000