A sea of red has covered the broad cryptocurrency market in the past day and many of the major digital currencies are down more than 10% in the past week. Typically, moves over ten percent in any financial asset would cause alarm among speculators, but these are cryptocurrencies we are talking about and traders not only expect the volatility, they often seek it.

Within the midst of this increase in price turbulence among the cryptos, USDT/USD continues to provide trades within its stable coin parameters. Tether is a slow mover and if a trader chooses to pursue speculative positions with USDT/USD they must be ready for incremental moves and understand exactly what their goals are before entering their trades. Interestingly, as the broad cryptocurrency market tumbled yesterday, USDT/USD correlated rather well with its counterparts. However, as of this morning, many of the major cryptocurrencies are still struggling near support levels, but USDT/USD has climbed within reach of the one-dollar mark.

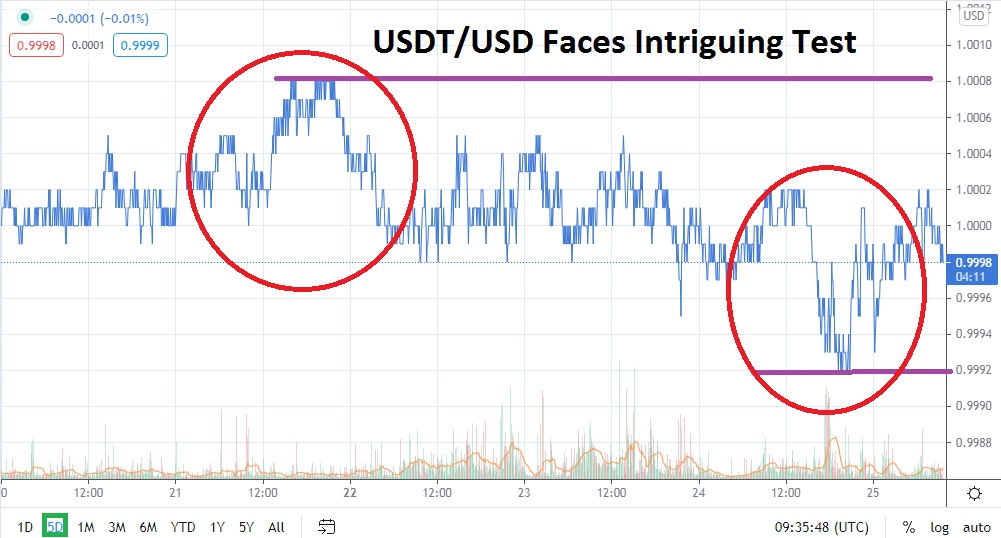

The downturn in the broad digital currency market may create some headwinds for USDT/USD short term. Resistance appears rather strong near the 1.0002 juncture and, short term, a target above around the 1.0004 mark may appear rather speculative. Traders need to understand the small scope of the potential moves within USDT/USD and if they are speculating and want a bang for their wager, the use of leverage becomes a key instrument. Technically, traders should consider both sides of the coin for USDT/USD – going long and short depending on chart movements.

If the broad cryptocurrency market stays under pressure near term, it might prove a solid speculative wager to sell USDT/USD on ticks higher. Selling on incremental moves higher which test nearby resistance levels and looking for downturns appears to be a logical technical endeavor for speculators. As of this morning, many major cryptocurrencies are trading near one week lows, USDT/USD moved to the 0.9992 level yesterday which it had not touched since the 13th of March.

USDT/USD acts as a solid barometer within the cryptocurrency sphere. If sentiment remains skittish within digital currencies short term, USDT/USD may continue to prove opportunistic for selling positions which seek support targets below. However, traders are reminded not to look for too much movement and expect incremental price action to rule the day.

Tether Short-Term Outlook:

Current Resistance: 1.0002

Current Support: 0.9996

High Target: 1.0004

Low Target: 0.9991