The USD/JPY pair succeeded in moving towards the 110.42 resistance level, its highest in a year, before settling around the 110.30 level as of this writing. The pair may be affected today by a trading session of utmost importance. It is the last day of this month and the first quarter of 2021. The US dollar will also interact a lot against the rest of the other major currencies, as US President Joe Biden presented in Pittsburgh the features of the stimulus plans in the US infrastructure after a stimulus plan was signed recently to support the US labor market.

The proposed tax increases will attract attention in addition to the price (estimated at $3 trillion). Biden called for restoring the corporate tax rate to 28% (from 21%) and implementing a minimum corporate tax rate of 15% for large corporations. He also favors raising the personal income tax rate of more than $400,000.

There are two main parts of the US infrastructure initiative, and it can be envisaged that they are presented as two bills, which may increase the chances of bipartisan support for one of them. There is the physical infrastructure: a power grid, roads, bridges, and Wi-Fi. It will include environmentally friendly initiatives that may overlap with parts of the Green New Deal. The other part of the infrastructure initiative will be about "human capital". This will likely include healthcare and education components. It may also seek temporary tax credits on earned income and tax credit adjustments for children in the $1.9 trillion stimulus bill.

The yield on US 10-year Treasury bonds reached new highs since January 2020, jumping above 1.77%, which helped raise global bond yields as well.

The nation's unemployment rate remained stable at 2.9% in February, defying expectations of an increase, although the jobs ratio declined as expected to 1.09 from 1.10. However, the most significant surprise was the Japanese retail sales rise in February, which increased 3.1%. The expected increase of 0.8% was canceled due to the 3.1% increase. Even when looking at the downward revision in the January sales numbers to -1.7% from -0.5%, the February report was impressive.

It was the first increase in three months and the largest since last June when the first state of emergency was lifted. While the demand for durable goods appears strong, the report may exaggerate the strength of consumption because it does not capture the decline in spending on services. However, economists may analyze a contraction forecast here in the first quarter.

We saw a jump in US consumer confidence in March to the highest reading in a year, buoyed by increased vaccinations and more government economic support. Accordingly, The Conference Board said that the US Consumer Confidence Index rose to 109.7 in March, which is the best offer since it reached 118.8 in March of last year when the outbreak began in the United States. The index reached 90.4 in February. Also, the Current Conditions Index, based on consumers' assessment of current business and labor market conditions, rose to 110.0, up from 89.6 in February. The Outlook Index, which is based on consumers' expectations of income, business and labor market conditions, also improved six months into the future, rising to 109.6 in March, up from a reading of 90.9 in February.

Most economists expect strong US economic growth in the coming quarters, supported by rising consumer confidence and consumer spending, which account for 70% of US economic activity.

Commenting on the numbers, Lydia Bosor, Chief US Economist at Oxford Economics, said, "The recovery in consumer confidence is expected to continue in the coming months, supported by a combination of improved health conditions and a wider distribution of vaccines." Therefore, this large consumer spending should support and pave the way for a small boom in economic activity this spring and summer.

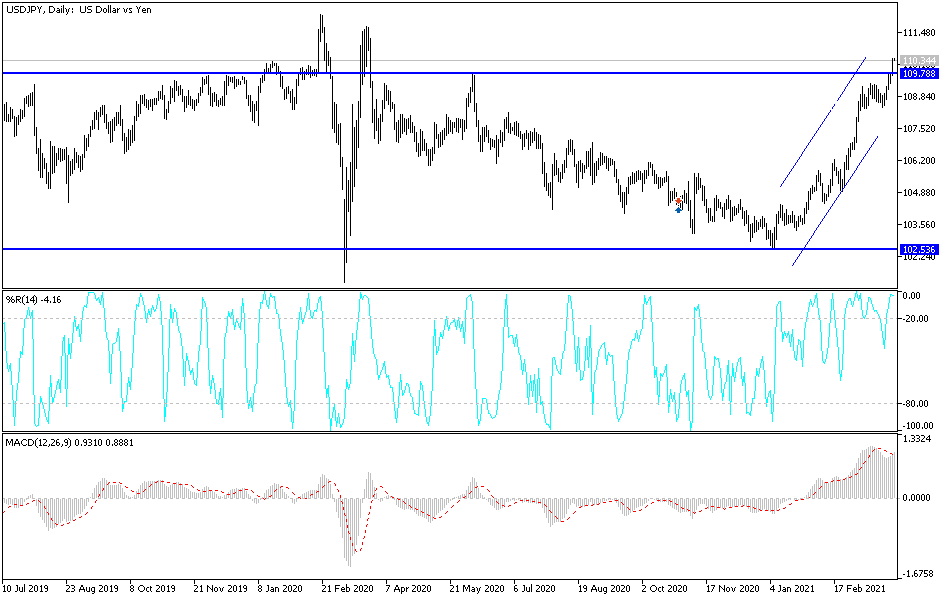

Technical analysis of the pair:

The recent gains in the price of the USD/JPY, according to the daily chart, pushed the technical indicators to strong overbought levels. Today's important events will have a strong reaction on all dollar pairs, and in the event that investors abandon the US currency, profit-taking may ensue quickly. If this happens, the currency pair will not exit from its current bullish channel without moving towards the psychological support level at 108.00. On the other hand, events and reaction came in favor of more dollar gains, so we do not rule out a move towards the 111.75 resistance level that the currency pair recorded in the first quarter of the year 2020, which is the time in which global financial markets were scared and anxious about the rapid spread of the coronavirus, which paralyzed the global economy as a whole.

All focus will be on the announcement of Joe Biden's plans. Then there will be an announcement of the ADP reading to gauge the change in the number of US nonfarm payrolls, the Chicago PMI reading and the pending home sales.