In the last three trading sessions of last week, the USD/JPY pair moved near the 110.00 psychological resistance by testing the 109.85 resistance before closing flat around 109.66. The US dollar gained strong momentum against the rest of the other major currencies amid optimism of Federal Reserve monetary policy officials regarding the country's economic recovery from the effects of the Corona pandemic, including more stimulus plans. This is in addition to the positive results of the recent US economic data.

Following in Trump's footsteps, the Biden administration is now challenging China, which has never embraced democratic values as advocates of trade believed it would. The White House has made it a priority to ensure the United States has a steady supply of vital goods such as computer chips, a sector increasingly dominated by China. The chip shortage is stifling car production worldwide, making it a threat to manufacturing jobs in the United States of America.

The US Commerce Department released a report showing that personal income fell sharply in February. The department announced that personal income decreased by 7.1% in February after rising by an upwardly revised 10.1% in January. Economists expected personal income to decline 7.3% compared to the 10% increase originally reported for the previous month.

The sharp decline in personal income primarily reflects a decline in government social benefits after the distribution of $600 in incentive checks in January. The report also showed that personal spending fell 1% in February after rising by an upwardly revised 3.4% in January. Economists had expected personal spending to decline by 0.7% compared to the 2.4% jump originally recorded for the previous month.

Meanwhile, the inflation reading said to be favored by the Fed showed that the annual rate of growth in core consumer spending prices slowed to 1.4% in February from 1.5% in January.

A separate report from the University of Michigan showed that US consumer sentiment improved by more than its previous estimate in March. The University of Michigan stated that the Consumer Confidence Index for March was revised upward to 84.9 from the initial reading of 83.0. Economists had expected the index to be revised up to 83.6. The Consumer Confidence Index is much higher than the last reading for February at 76.8, marking its highest level since it reached 89.1 in the same month last year.

More than 89.5 million people, or 27% of the US population, have received at least one dose of the coronavirus vaccine, according to the Centers for Disease Control and Prevention. About 48.6 million people, or 14.7% of the population, have completed their vaccinations. Regarding the number of cases, the seven-day average of daily new cases in the United States over the past two weeks rose from 55,516 on March 11 to 58,617 last Thursday, according to Johns Hopkins University.

The seven-day rolling average of new daily deaths in the US over the past two weeks has fallen from 1,371 on March 11 to 967 on Wednesday, according to Johns Hopkins University.

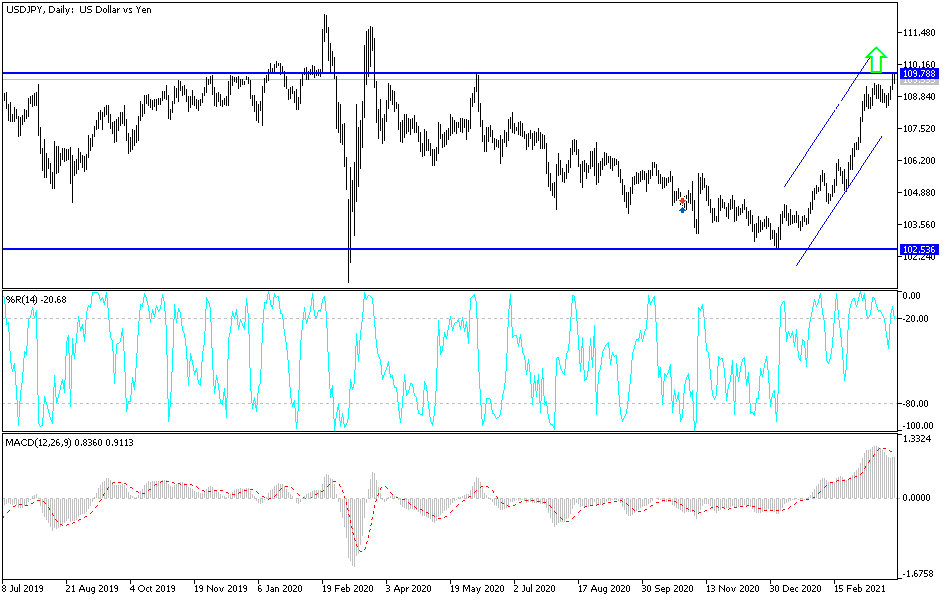

Technical analysis of the pair:

The recent upward momentum pushed the USD/JPY towards its highest in nearly ten months. Moving towards and above the psychological resistance 110.00 will push the technical indicators to strong overbought levels. Therefore, breaking that resistance will start profit-taking, likely at the resistance levels of 110.25, 111.00 and 111.85.. On the downside, moving back below the support level of 108.00 will enable the bears to take control again.

The currency pair does not expect any important data from Japan or the United States, and accordingly, investor risk sentiment will be a factor affecting the currency pair's movements.