The USD/JPY currency pair has given up some of its recent gains which reached the 109.36 resistance level, the pair's 9-month high. It retreated to the 108.74 support level and settled around there at the time of writing. The US dollar retreated against the rest of the other major currencies after the US Federal Reserve announced the details of its monetary policy, stressing that US interest rates should be maintained at their historically low level for a longer period, not before than 2023. The bank has confidence in a strong US economic recovery this year, with the continued provision of vaccines to more Americans, which contributed to the intention of some states to reopen economic activity, which will be positive for the US economy for the remainder of the current year 2021.

The Fed’s monetary policy meeting this week came as the outlook for the US economy has improved significantly since its last meeting in late January. Job gains accelerated in February, sales jumped at retail stores after $600 relief checks were distributed at the start of the year and US President Joe Biden signed his economic relief package into law last week. The average daily COVID infections have also decreased sharply. Vaccinations have accelerated, raising hopes that Americans will travel, shop, eat out and spend freely.

As a result, economists have upgraded their outlook, with many predicting that the US economy could see up to 7% growth in the entirety of 2021. This will be the fastest annual growth since 1984. The brighter outlook sent bond yields down and Treasuries rallied this year as investors dumped bonds, which are usually safe investments during recessions.

However, the US labor market still has a long way to go towards a full recovery. With an unemployment rate of 6.2%, the economy still has 9.5 million fewer jobs than it did before the outbreak a year ago.

Investors will still scrutinize the Fed’s response to the recently improved US economic outlook that has supported investors betting that the bank will scale back its quantitative easing program and raise interest rates as soon as possible by 2023. This has undoubtedly played a role in doubling some of the government bond yields.

The yield on US 10-year Treasury bonds was around 1.40% when Powell told Congress in early March that the Fed was not concerned about increases in borrowing costs, before suggesting to lawmakers that the latter only reflected the economy in recovery and that the market had become confident of its outlook. But the 10-year yield climbed above 1.66% yesterday.

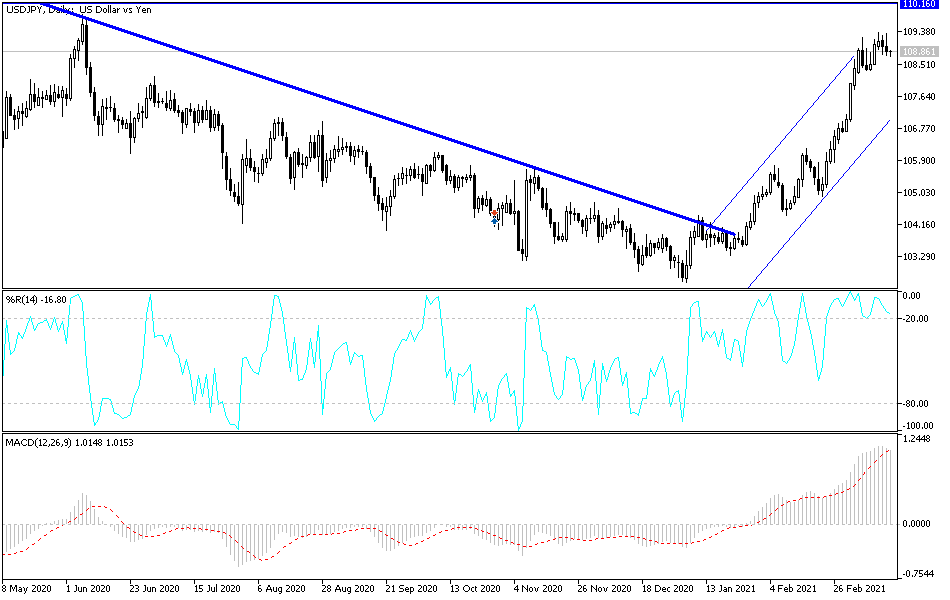

Technical analysis of the pair:

On the daily chart, the USD/JPY is still moving within its ascending channel, and a breakout will not occur without the bears succeeding in pushing the currency pair towards the support levels of 107.85 and 106.90. On the upside, psychological resistance at 110.00 is an important target for bulls. At the same time, approaching it will support the movement of technical indicators to strong overbought areas, from which profit-taking can be activated.

The currency pair will be affected today by the extent of risk appetite, as well as the reaction from the announcement of the number of weekly jobless claims and the reading of the Philadelphia Industrial Index.