The USD/JPY is continuing its upward rebound since crossing the barrier of the 106.00 resistance level seven months ago, settling around the 107.10 level as of this writing. The performance is still good, and the strength of the US dollar against the rest of the major currencies may be affected by the comments US Federal Reserve Chairman Jerome Powell and the announcement of US jobs numbers.

Yesterday, a sharp setback was announced for US jobs in the non-agricultural sector, according to the ADP survey, which detected only 117,000 new American jobs, and expectations were to add 177,000 jobs. Growth in the US services sector, where most Americans work, slowed sharply in February, with epidemic-related obstacles holding back growth. The Institute for Supply Management said that its index of service sector activity fell to a reading of 55.5% in February, down 3.4 percentage points from January, when activity approached its highest level in two years.

Even with the decline, it was the ninth consecutive month of growth in the services sector. Any reading above 50 indicates growth.

Economists had expected some pullback from the January high, but the scale of February's drop was much larger than expected, driven by a sharp drop in the New Orders Index. That fell to a reading of 51.9%, down from January's reading of 61.8%. The readings of the Trade Activity and Employment Index also decreased from the previous month.

Andrew Hunter, Chief US Economist at Capital Economics, noticed that price pressures jumped sharply in February with the Price Index rising to a reading of 71.8%, a level he said indicated that the Fed's preferred rate gauge could rise by about 2.4% within the next few months. The Fed's target for inflation is 2%, but Fed officials have said they expect a temporary jump in rates in the coming months as the country reopens, but they do not expect inflation readings to continue.

So high energy prices are affecting the supply chain that relies heavily on trucks to transport products to retail stores and other institutions, said Anthony Nevis, Chair of the ISM's Service Survey Committee. Many analysts saw the slowdown in service sector activity in February as just a short retreat from the high in January with more gains coming in the coming months.

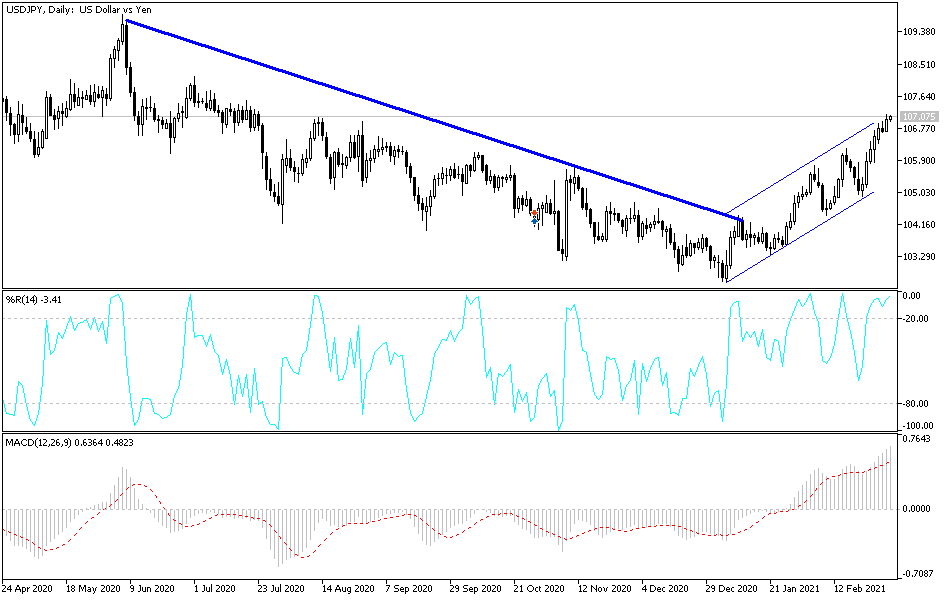

Technical analysis of the pair:

On the daily chart, the USD/JPY is still moving in the range of its bullish channel, which is supported by stability above the resistance 106.00. A move higher than the current levels will push the technical indicators into strong overbought areas. This may pave the way for profi-taking, in the event that more momentum is not provided to the US dollar, which is awaiting Jerome Powell's comments and US jobs numbers. The closest resistance levels for the pair are currently 107.35, 108.20 and 109.00.

On the downside, the bears will not return to control the performance without breaching the support level of 105.70. The US dollar will be affected today by announcements of weekly jobless claims, non-farm payrolls and statements from Federal Reserve Chairman Jerome Powell.