The recent gains of the USD/JPY pushed the pair to a 9-month high of 109.24, but profit-taking sent the pair down to the 108.33 support level, where it has settled as of this writing. The profit-taking came as technical indicators reached strong overbought levels and the US dollar gained.

US consumer prices rose 0.4% in February, the largest rise in six months, led by a sharp jump in gasoline prices. But core inflation, excluding food and energy, posted a much smaller 0.1% gain, dampening concerns about a possible sustainable acceleration in inflation. For its part, the Labor Department said that progress in February in the Consumer Price Index came after a 0.3% rise in January and was the biggest advance since a similar 0.4% increase in August. US consumer prices rose 1.7% over the past year, a still moderate performance for inflation that falls short of the Fed's 2% target. Core inflation, which excludes volatile food and energy, has only increased 1.3% in the past twelve months.

However, financial markets have been in turmoil in recent weeks due to concerns that inflation could suddenly start to rise at a faster rate, prompting the Federal Reserve to start raising interest rates that are stabilizing around a record low since the pandemic broke out a year ago.

Core inflation is more important but could not be worse for the currency and bond and equity markets which in recent weeks have been very tense due to upside risks to the Fed's inflation target. On the other hand, the progress made by the United States of America in intensifying its vaccination campaign has boosted growth expectations this year and next, while some investors have speculated that at least a brief period of hyperinflation may force the Fed to raise interest rates before 2023.

Commenting on this, James Knightley, Chief Economist at ING Bank, said: “While officials remain largely relaxed, we believe that US inflation could remain elevated over the next year, which could prompt the Fed to take early action on interest rates more than it indicates. We are a little less relaxed than Jerome Powell, who only last week suggested that high inflation readings would be "temporary" and that the deeply ingrained "low inflation" notion will not fade away quickly. We believe that US inflation could remain in the 2.5-3.5% range for the next two years which, if correct, indicates further upward pressure on long-term Treasury yields.”

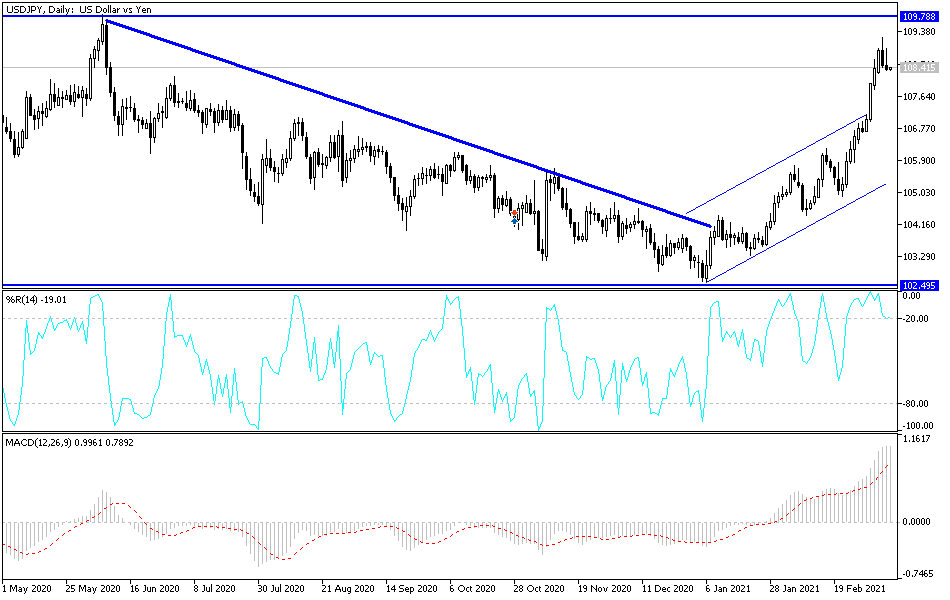

Technical analysis of the pair:

Despite the recent decline of the USD/JPY, the general trend of the pair is still bullish. On the daily chart below, there has been no breakout yet below the ascending channel that was recently formed. The bulls' most important target now is the psychological resistance at 110.00. There will be no strong control of the bears without breaching the support levels at 106.85 and 105.90. Technical indicators are still giving overbought signals, and unless the dollar gets more momentum, selling may increase in the coming days.

The yen will be affected by the extent of investor risk appetite, in addition to the announcement of the PPI reading in Japan and the announcement of the number of weekly US jobless claims. The upcoming US stimulus plans will have a strong reaction to the performance of the currency pair.