The USD/JPY is still moving in an upward channel, having broken through the 106.00 resistance level to reach the 106.96 resistance level before settling around 106.65 as of this writing. The pair is awaiting stronger incentives to complete the upside path instead of triggering profit-taking sales. The US dollar is still supported in the Forex market by the gains of the bond market, which confirms widespread bets that the US economy is likely to cause a strong recovery if vaccinations succeed and lead to an easing of restrictions.

US President Biden said that China is facing "intense competition" from the United States under his administration, but that the new relationship he wants to establish does not have to be a conflict. The COVID-19 pandemic, which originated in China, has strained the relationship between the two countries, as members of both US political parties work to highlight any arrangements they see the other side making toward China.

Various states are easing restrictions. Like the rest of the country, Texas has seen a decrease in the number of injuries and deaths. Hospitalizations are at their lowest since October, and the seven-day rolling rate for positive tests has dropped to around 7,600, down from more than 10,000 in mid-February. Only California and New York have reported more COVID-19 deaths than Texas.

President Joe Biden said that the United States expects to deliver enough vaccines to all adult Americans by the end of May, two months earlier than his previous July deadline, as his administration announced that the drug company Merck & Co. helped produce a competing vaccine to Johnson & Johnson's. The announcement comes as the White House looks to speed up production of a single dose of the J&J vaccine and speed up the nation's plans to reach "herd immunity" in the United States and begin to restore normalcy after the pandemic.

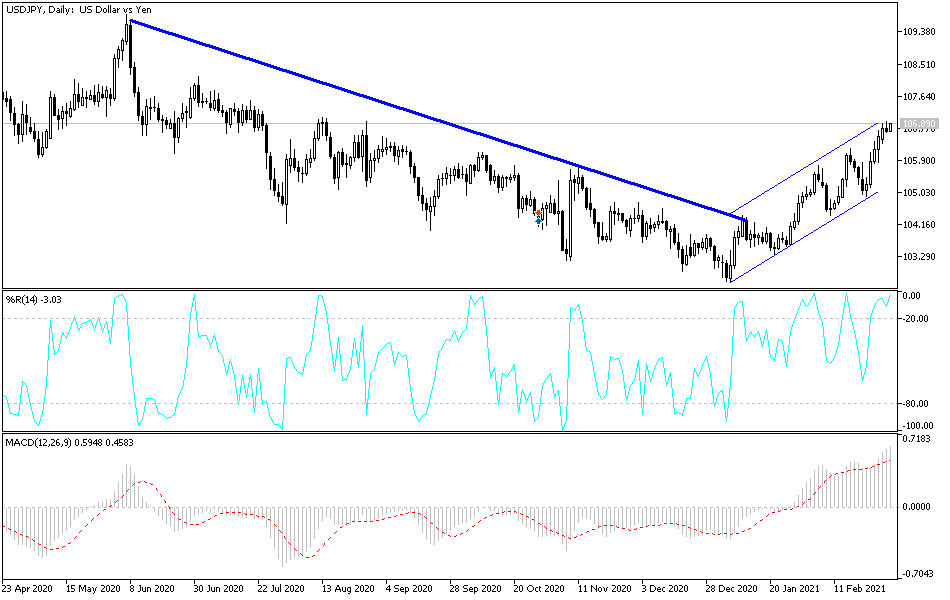

Technical analysis of the pair:

The stability of the USD/JPY above the 106.00 resistance supports the bullish trend. It seems clear that the pair will move within the bullish channel range, and surpassing the 107.20 resistance will push technical indicators into strong overbought areas, so the pair may experience profit-taking at any time. This is especially if investors return to safe havens, the Japanese yen being among the most prominent of them. The performance will not turn bearish without moving towards the support levels of 105.65 and 104.80.

In addition to the extent of investor risk appetite, the currency pair will be affected today by the announcement of the ADP survey to measure the change in the number of non-farm US jobs and the reading of the ISM Services PMI.