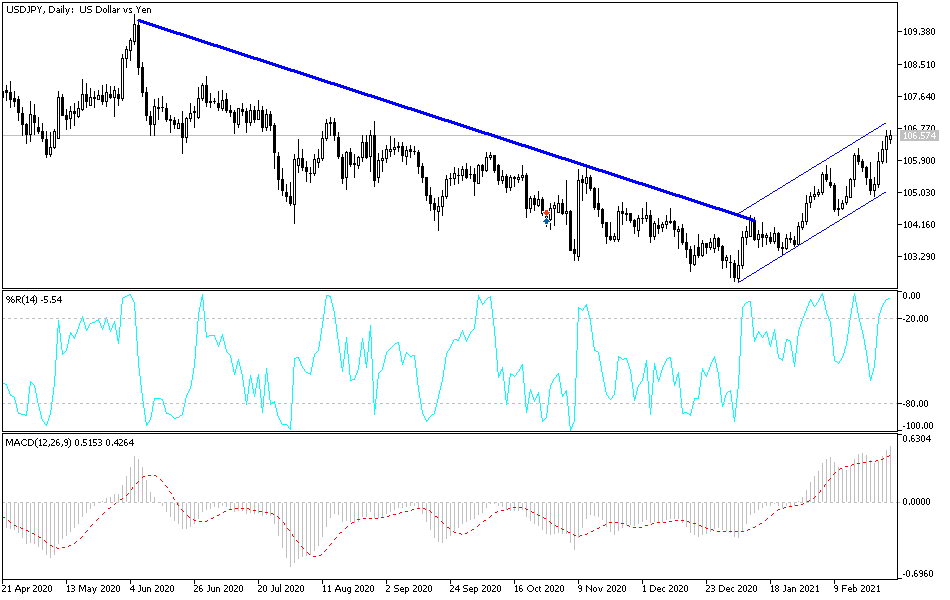

The USD/JPY corrected to the upside last week with gains reaching the 106.70 resistance level before settling around 106.53 at the beginning of trading on Monday. As I mentioned before, stability above the 106.00 resistance will support a correction to the top and a clear breach of the sharp bearish channel, which caused the collapse of the currency pair to 102.60 in early January 2021 trading, its lowest since March 2020.

Financial markets, including the Forex market, may get strong support after the US House of Representatives approved a stimulus bill worth $1.9 trillion. There was quasi-partisan support with 219-212 votes. The bill will now be sent to the Senate, where Democrats appear intent on increasing the minimum wage, which they added to the bill.

Democrats said the US economy, which is still faltering amid the loss of half a million Americans killed by the epidemic, requires swift and decisive action, though many of the funds in the proposed bill would not even be doled out until 2023. Republicans see the bill as largely wasteful, as it contains funds and proposed laws that are unrelated to the coronavirus, such as a $15 minimum wage hike, which would not even take effect for another 3 years. They also said it was loaded with gifts for Democratic circles like labor unions and Democrat-run states who are not under-budget.

A US advisory panel has approved a new, single-dose Johnson & Johnson COVID-19 vaccine as a third option to bolster national efforts against the coronavirus pandemic. The Center for Disease Control and Prevention voted overwhelmingly to recommend the vaccine for adults ages 18 and over. The ruling came after an emergency declaration of the vaccine by US regulators the day before. The group members emphasized that all three vaccines now available in the United States provide high protection against the worst effects of the virus, including hospitalization and death.

Technical analysis of the pair:

On the daily chart, the USD/JPY is still moving within its recently formed ascending channel. Investor sentiment towards this week’s events, especially with regard to the approval of US economic stimulus plans, Jerome Powell’s statements and US jobs numbers, will impact the future of recent gains. The closest resistance levels for the pair now are 106.85, 107.25 and 108.00, and the last level will be an important factor for bulls to launch into the psychological resistance of 110.00, which has always been shown to be a sign of strength and improvement in investor sentiment.

On the downside, the currency pair may abandon its current bullish path if it moves below the support level of 104.90. In addition to the extent of investor risk appetite, the currency pair will be affected today by the reading of the Chinese Industrial Purchasing Managers Index (PMI) and US data, including the US ISM Manufacturing PMI reading and the US Construction Spending Index reading.