We have witnessed competition between safe havens to achieve the largest gains, due to risk-averse sentiment that has dominated global financial markets recently. This sentiment comes after renewed COVID restrictions and lockdowns, which affect the global economic recovery expected this year. There has been instability in the performance of the USD/JPY with bearish tendency, as it moved towards the support level of 108.40, its lowest level in two weeks, before settling around the 108.95 level at the time of writing. Overall, the Japanese yen has advanced against nearly all of its major currencies this past week except for the USD/JPY, which is up only 0.02%, although the dollar has defied gravity to outpace all other competitors in the meantime.

The Japanese yen retreated from its recent lows since the Bank of Japan's monetary policy decision in March, which affected Japanese government bond yields in a way not much different from how the interest rate was raised. This resulted in the Bank of Japan expanding the ranges in which the yield of ten-year bonds could trade in an environment of controlling the yield curve while providing a provision for commercial banks to earn an improved interest rate on cash reserves deposited in the Bank of Japan.

However, these policy decisions were not a reflection of the Bank of Japan, which is close to becoming hawkish, but rather a delicate policy process designed to provide the bank with scope to cut bond yields and interest rates as a policy response to any new challenges the Japanese economy faces in the future. In other words, it is only a side effect of this and it is likely that it was a short-term effect that enabled the Japanese yen to outperform last week, and therefore analysts believe that the Japanese yen is likely to remain under pressure in the coming quarters due to reduced demand for safe haven amid a recovery.

Treasury Secretary Janet Yellen thinks the US government has more room to borrow, but said that higher taxes are likely to be needed in the long run to fund spending increases in the future.

Yellen appeared on Wednesday before the Senate Banking Committee as the Biden administration considers up to $3 trillion in additional spending on infrastructure, green energy and education. The "Build Back Better" plan will follow the $1.9 trillion economic relief package approved earlier this month. Accordingly, Yellen said her views on borrowing have changed since 2017, when she expressed concerns about the federal debt, which was equivalent to about 75% of the US economy's output at the time. This percentage has since risen to just over 100%.

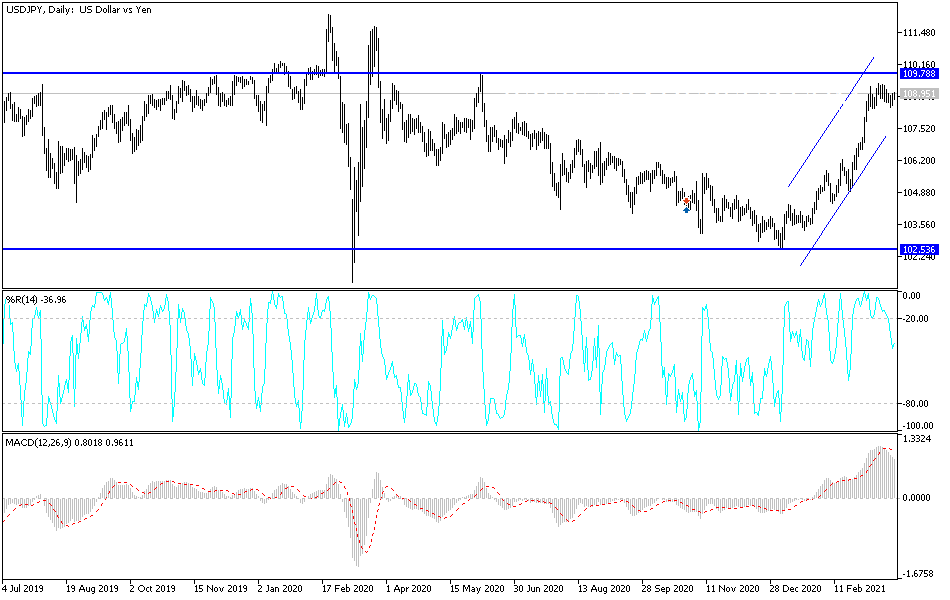

Technical analysis of the pair:

The USD/JPY has long moved in narrow ranges with a bearish inclination. I expect a strong move soon in one of the two directions. The current bears will gain control in the event that the currency pair moves towards the support levels 108.35, 107.80 and 107.00. On the upside, I still see the breach of the psychological resistance at 110.00 as very important for bulls to control the performance. I still prefer to buy the currency pair from every downside.

The currency pair will be affected by investors risk appetite, as well as the announcement of the US GDP growth rate and the weekly jobless claims.