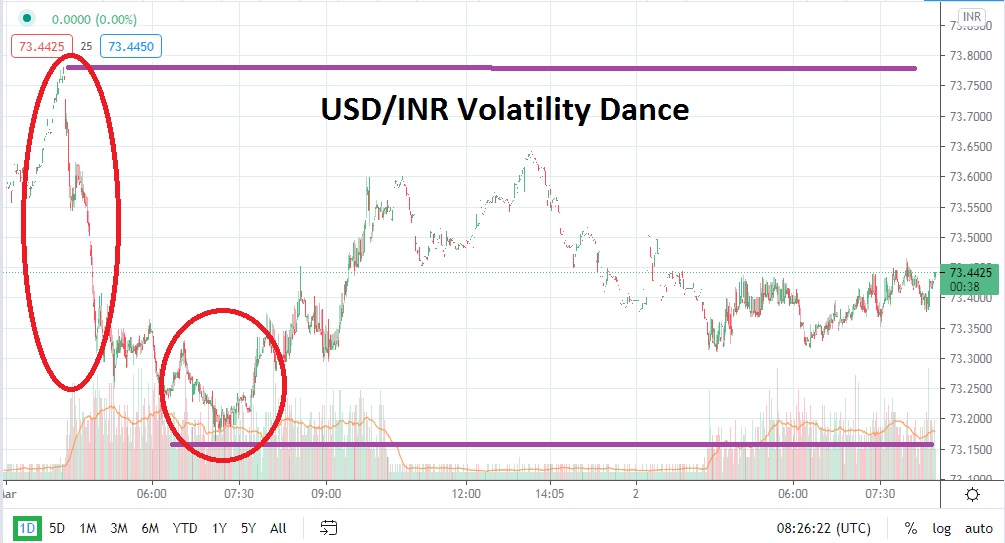

Speculators who have been pursuing the bearish trend within the USD/INR were delivered a violent reminder late last week that the Forex pair is capable of swift surges. The USD/INR was trading in an almost tranquil manner and challenging values near long-term lows around the 72.430 vicinity and allowing traders to be comfortable within their perceptions early last Monday and Tuesday.

Unfortunately, late last week, global markets turned sour as the US government bond market saw a surge of activity and worldwide financial institutions had their focus shifted to hedge risks. The global Forex environment experienced strong reversals and the Indian rupee did not escape this fate. The USD/INR broke through resistance levels easily and climbed to a high of over 74.000 on Friday.

If a trader was lucky enough to be long the USD/INR and looking for a nice short-term reversal higher, it is possible they are now counting a solid cash profit in their trading accounts. However, when the USD/INR began to trade in earnest yesterday, it simmered down and actually started to crawl towards its recent value range, but it is still some distance away from the marks it was traversing only five trading days ago.

The notion that the USD/INR remains above its mid-term value range may attract speculators who like to believe they can take advantage of imbalances in Forex. As of this writing, the USD/INR is near the 73.400 ratio and is challenging short-term support levels. For a brief couple of moments early today, the USD/INR has already seemed to target the 73.300 level below but been hit by a couple of reversals higher.

Traders should consider risk/reward scenarios within the USD/INR. It is no certainty that the Forex pair will immediately recapture its lost ground from last week, but there has been a demonstrable amount of evidence that the USD/INR is capable of tracking lower after suffering reversals higher the past six months. The long-term bearish trend of the USD/INR remains intact technically, and traders may believe that resistance could prove adequate after the violent surges seen late last week and act as stop loss ratios.

Selling the USD/INR and seeking lower values seems to be the logical pursuit for speculators near term. Shorting the Forex pair with limit orders slightly above the current market price appears to be a legitimate wager which could be worthwhile.

Indian Rupee Short-Term Outlook:

Current Resistance: 73.570

Current Support: 72.300

High Target: 73.790

Low Target: 73.080