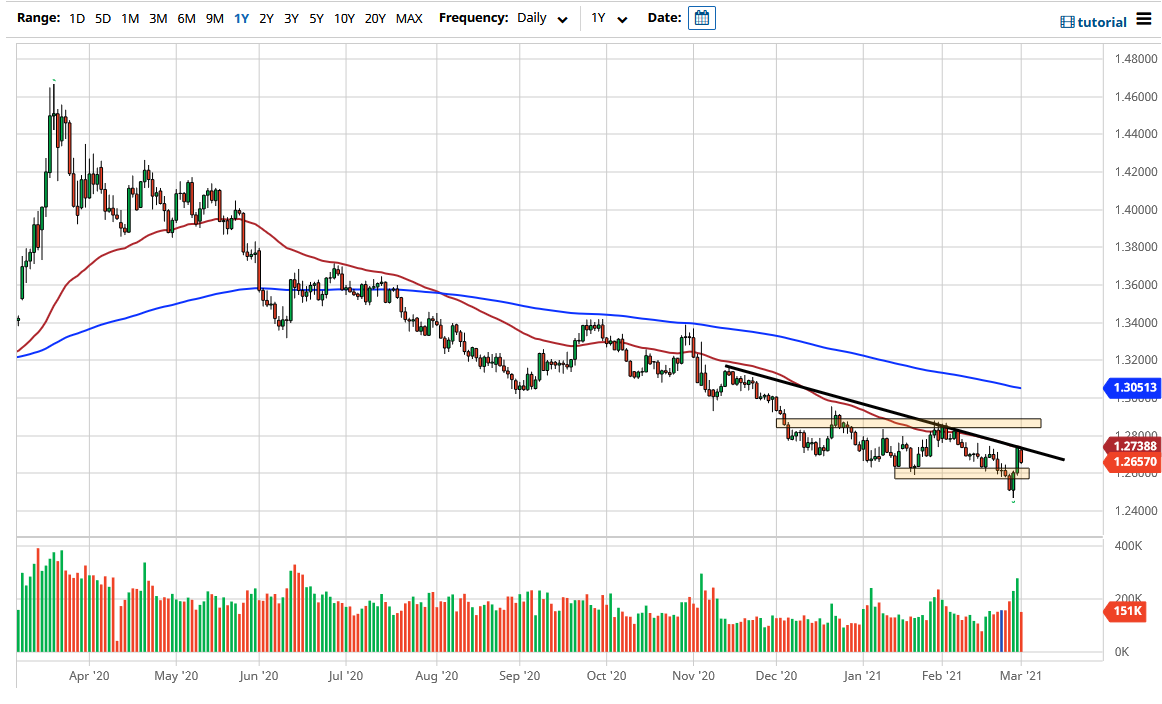

The US dollar initially tried to rally a bit against the Canadian dollar on Monday, but as you can see on the chart, there is a major trendline that the market was repulsed to buy. At this point, the market looks as if it is trying to reassert the downtrend, as the crude oil market has seen a lot of hot money flow into it as of late. This obviously is good for the Canadian dollar, which represents an oil-exporting country and economy, so it should not be a huge surprise.

The most pressing thing here is the fact that we are starting to see a continuation of the overall downtrend, as the trend line has been so clearly defined, and we have seen the 50-day EMA walk right along this trend line as well. That is plenty of reason to think that there would be sellers in that general vicinity, and the fact that we are closing towards the bottom of the range does in fact suggest that we could see a little bit more selling pressure.

However, the monthly candlestick for the pair was a massive hammer, which is a bullish sign. We are also getting very close to the bottom of the overall range over the last several years, and the 1.25 level should be massive support. I believe that this pair is going to be very noisy and be a direct mirror image of crude oil. This brings me to the point that the crude oil market is heading towards massive amounts of supply, so if the crude oil market sells off, that could line up nicely for a move to the upside here. The US dollar really did a number against commodity currencies late in the month of February, so we will have to wait and see whether or not it can actually happen; but in the short term, it certainly looks like the overall trend to the downside should continue. A move above the downtrend line on a daily close could get me buying though, and that is something that I will be paying close attention to. It would need to coincide with a drop in the crude oil markets, so I need both of those signals to get long of this pair, but if we did turn around, we could see a move towards the 1.30 level rather quickly, and then perhaps even as high as 1.40 over the longer term if things really take off.