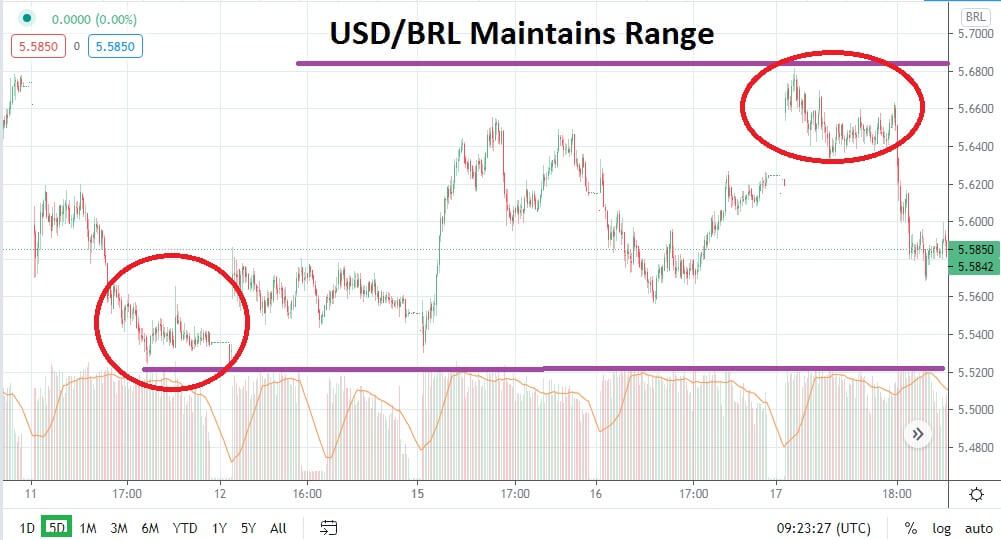

The USD/BRL moved lower yesterday after touching higher values and underscores the Forex pair’s ability to deliver a rather choppy range. Traders who use an abundance of leverage while speculating on the USD/BRL have likely had their stamina tested the past day as the Brazilian real went to a short-term high and then reversed lower. The USD/BRL is still trading above the majority of its February value range.

After beginning to climb higher on bullish sentiment the last week of February and into March and achieving a high of nearly 5.8700 on the 8th of this month, the USD/BRL has certainly moved lower since then. The question for speculators is whether the USD/BRL will be able to maintain its very short-term bearish trend or if it will once again start to deliver choppy trading conditions.

Support near the 5.5500 level is close and an important inflection mark near 5.5200 is within sight. If these support junctures are tested and actually are punctured lower, speculators may have reason to suspect that the USD/BRL may be inclined to try and re-engage values which have not been traversed since the early part of February until the last week of the month.

The USD remains weak in many respects against many currencies in Forex, but the USD/BRL has not exactly joined the bearish parade, and in fact has proved difficult to correlate for traders who have bearish sentiment regarding the world’s biggest currency. A range of 5.3500 to 5.4800 for the USD/BRL somehow feels miles away technically even though this proved to be a rather solid value band from January until the third week of February.

Speculators should continue to practice careful risk management with the USD/BRL and have short-term goals as targets. While it may feel right to believe the Brazilian Real should establish some type of longer term bearish trend against the USD, this has not been easy to produce. The choppy nature of the USD/BLR may remain the dominant feature of the Forex pair.

However, in the short term, if traders want to sell the USD/BRL on small moves higher and use limit orders, this may be able to result in worthwhile trading opportunities. Traders should not be too greedy with their targets and instead use quick-hitting positions and try to cash in profits when they are produced, instead of letting them linger on their trading platforms and potentially watch them vanish.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.6150

Current Support: 5.5500

High Target: 5.6400

Low Target: 5.5240