The S&P 500 initially tried to rally during the trading session on Wednesday but then pulled back enough to show signs of weakness. All things been equal, this is a very negative sign but I have no interest in trying to short the S&P 500, because it has such a nasty habit of shooting straight up in the air after somebody gets involved. That person is typically Jerome Powell, but we could also see Janet Yellen, or perhaps a whole host of other monetary officials.

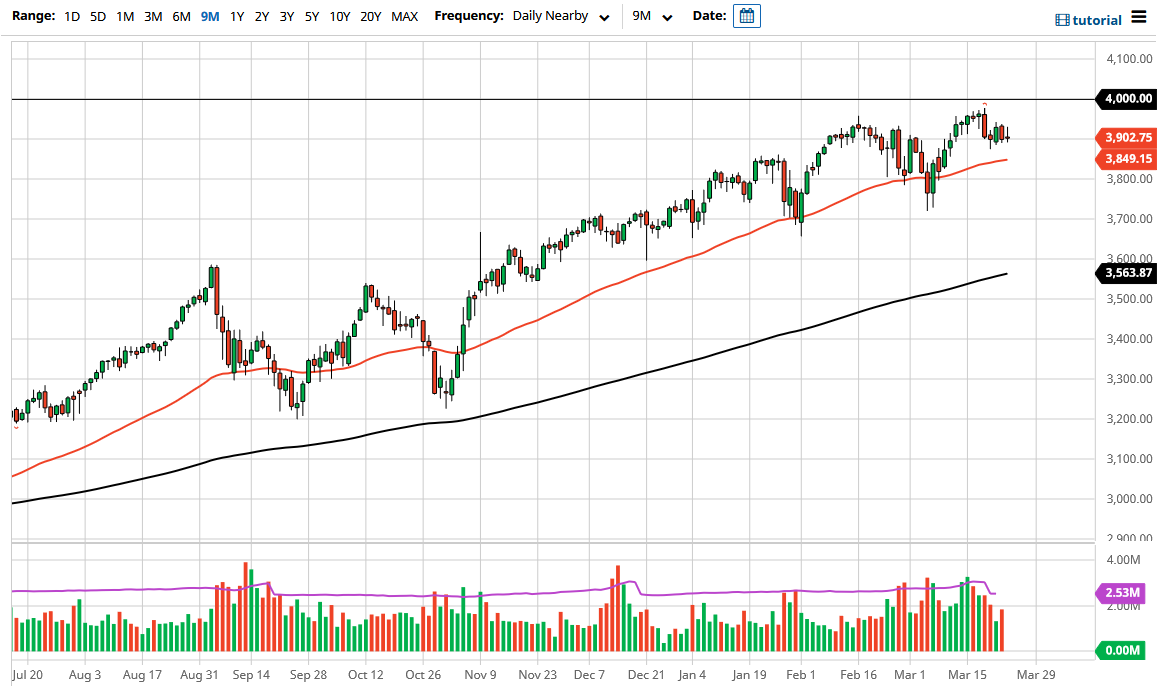

The 50 day EMA currently sits at the 3850 level, and I think that is a technical indicator that a lot of people will pay attention to if we do pull down to it. If we break down below there, then it is possible that the market goes looking towards the 3800 level. Underneath there, then it is possible we could go down to the 3700 level. All things being equal, I think that this is a market that you could buy puts and if you think it is going to get ugly, but I would not be a seller because of that monetary manipulation that we see so often.

The candlestick is a bit of a shooting star, and as a result it certainly looks as if there is a lot of weight above that could cause some issues. Having said that, if the market was to break above the top of the candlestick, then it is possible that we could go to the 3950 handle, and then perhaps even the 4000 level eventually. The 4000 level would obviously be a large figure that a lot of people would pay attention to, causing a lot of headlines and of course a lot of volatility.

This is an area that is going to have a lot of options attached to it as well, so that volatility and of itself will be a major issue. If we can close above there on a daily chart, then the market is likely to go looking towards the 4100 level. I think it is only a matter of time before we get to the 4000 handle, but that is not a seller me that we should jump in and buy the S&P 500 right here. I think the volatility continues to cause major issues in this market, so finding value is probably the best way forward.