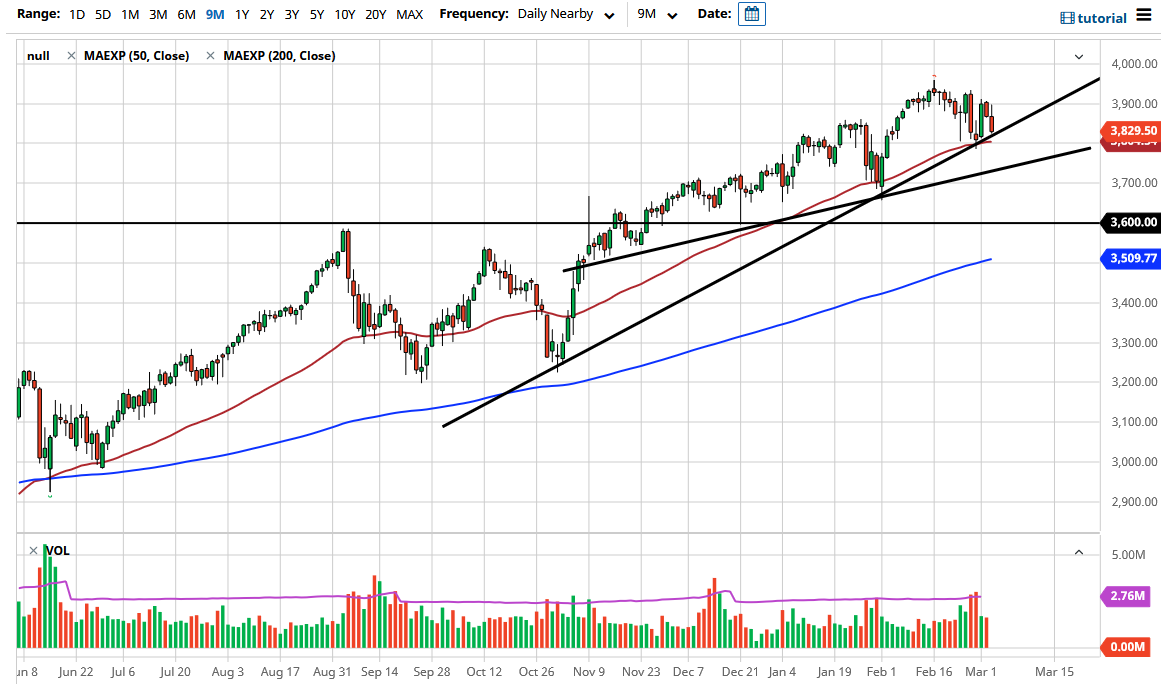

The S&P 500 initially tried to rally during the trading session on Wednesday but gave back a significant amount of gains as we reached towards the 3900 level. The 3900 level is a large, round, psychologically significant figure, and the fact that we turned around from there to reach down towards the uptrend line is a bit telling, suggesting that we are trying to figure out where to go next.

The 50-day EMA sits just below the uptrend line and at the 3800 level. After that, we have an uptrend line that we will probably challenge, so that is worth paying attention to as well. The candlestick itself does not look that good, but we are heading towards the non-farm payroll figures for Friday, so Thursday might be a little bit quiet. If we do get a massive spike in yields though, that could send this market towards the lower uptrend line. I suspect that regardless, we probably will not make a major move until after we get those jobs figures, and one has to wonder whether or not this is simply another “bad news is good news” type of situation.

Looking at this chart, I still believe that the 4000 level is a target for longer-term traders, especially as the previous consolidation between 3200 and the 3600 level measures for that move based upon extrapolating the distance of the breakout. I do not have any interest in shorting this market, but I do recognize that we are possibly under threat of some type of correction. I think more will be known after the Friday session, because we will have a lot of noise coming go, perhaps causing more positioning.

We are still very much in an uptrend, and it is possible that the uptrend line that sits underneath the one that we are at right now makes sense, because it is at a more sustainable angle. I do not short the US indices, because although they are prone to crash occasionally, the Federal Reserve and government both will step in the way and cause issues if it starts to fall too much. I believe we need to see this market stabilize more than anything else before putting money to work.