The S&P 500 fluctuated during the course of the trading session on Tuesday as we await the FOMC meeting conclusion on Wednesday. After all, the markets are highly sensitive to interest rates, and they have been all over the place. At this point, we are waiting to see whether or not the Federal Reserve will do something about yields, talking down the bond market. We have seen bond sell-offs driving up yields quite drastically. Those higher yields make the US dollar little bit more attractive, and stocks quite a bit less due to the fact that you can simply clip coupons to make a return.

If Jerome Powell does not mention anything about paying attention to yields, the reality is that yields will spike further, and that probably will send the S&P 500 much lower. I do think that the S&P 500 will probably outperform as a lot of the other indices in America, simply due to the fact that there are a lot of value companies in that index. If the Federal Reserve does something about yields, it is probably a fair bet that the market is eventually going to break above the 4000 level.

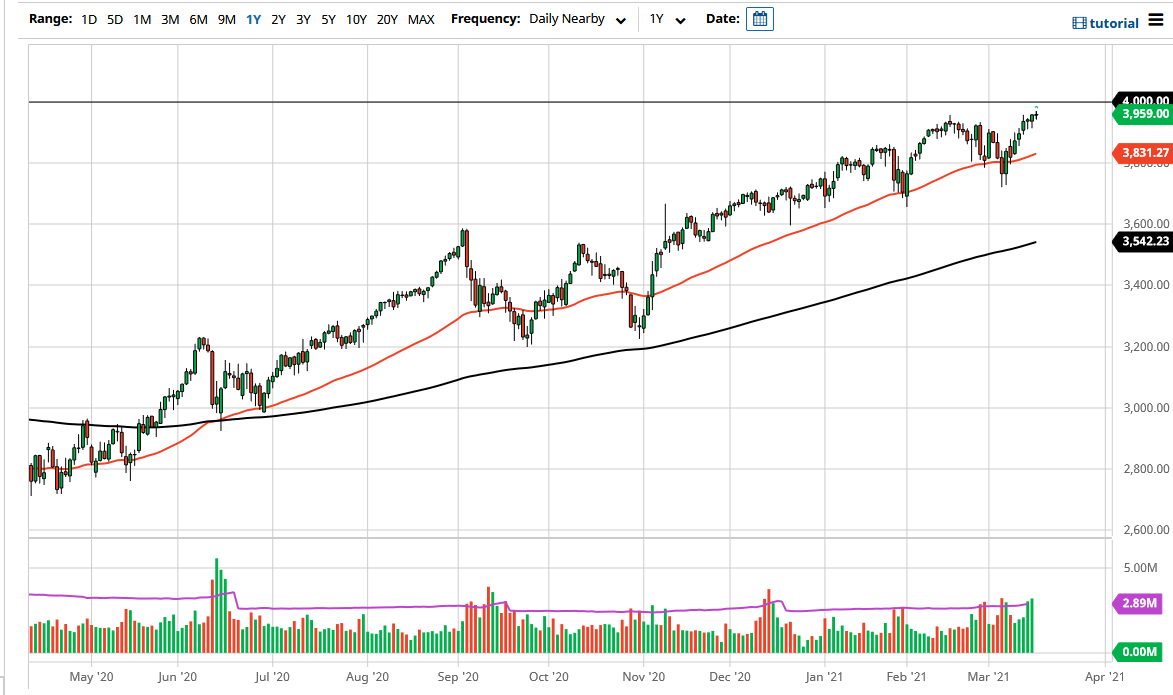

Keep in mind that the 4000 level is a large, round, psychologically significant figure that will attract a lot of attention, so it is likely that the markets will look at that as a major victory. Therefore, if we can break above there, then the market is likely to go much higher. However, that does not mean that we will simply slice through there. I do think that if the market were to break above there, we may have to bounce off it a couple of times. To the downside, I think that the 50-day EMA is going to continue to offer support, so it is only a matter of time before we would see value hunters coming back in. On a breakdown I would be looking for some type of supportive daily candlestick that is worth taking advantage of. I have no plans whatsoever in shorting the S&P 500 or any other US index for that matter, as the markets have been far too manipulated to fight the central bank.