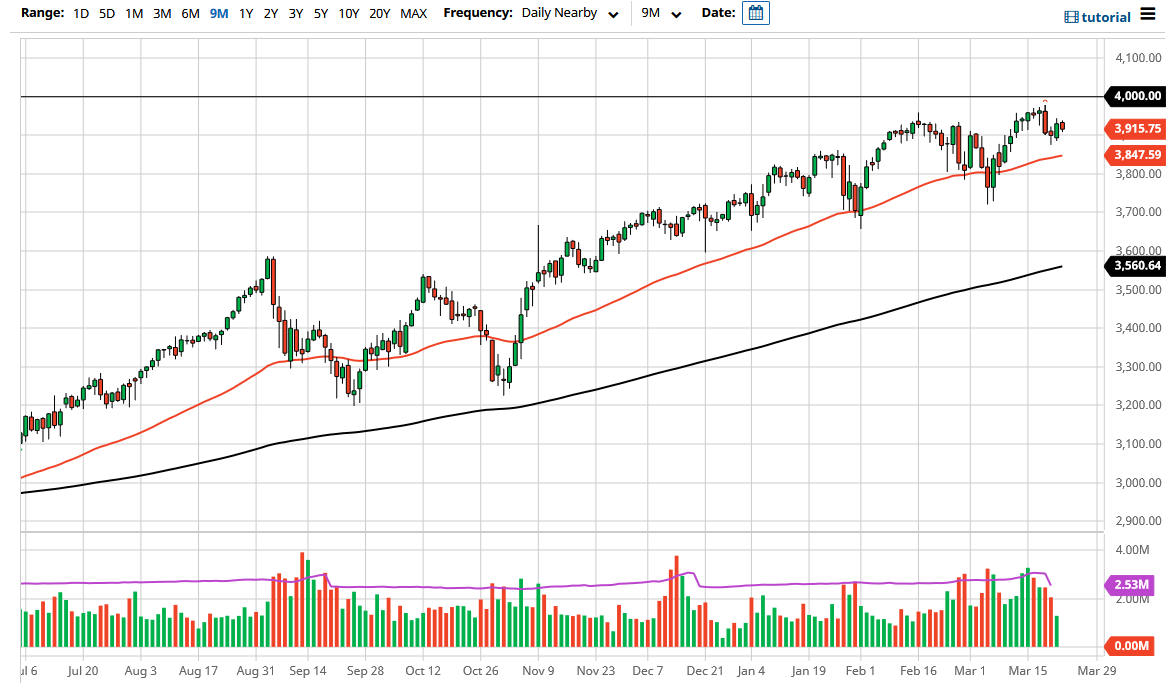

The S&P 500 has pulled back a bit during the course of the trading session on Tuesday as we continue to see a lot of volatility just above the 3900 level. At this point, I think that the market is trying to figure out where to go next, and with Janet Yellen speaking during the day on Wednesday it should not be a huge surprise that the markets are waiting to see what she is going to tell Congress. That being said, it is likely that the 3900 level will continue to be important, and most certainly the 50 day EMA underneath will be.

I also like the idea of buying at the 3800 level and finally at the 3700 level. This is a market that has been in an uptrend for some time, and we all know that the Federal Reserve is going to continue to be aggressive when it comes to monetary policy being soft, and the market likes that. This does not mean that there will be the occasional hiccup, but any time we see some type of liquidity issue, then the market is going to sell off quite drastically. If we do see some type of huge move to the downside, I would be a buyer of puts, not somebody who sells this index as that is a great way to lose money. Yes, there has been a couple of times recently where we have seen massive selloff, but at that point you have to be a buyer of puts, not somebody who is willing to take on the risk of shorting.

More likely than not, I will be looking for supportive candlesticks that I can take advantage of, preferably on the daily timeframe. With that being said, I think a lot of patients will be needed but clearly this is a market that is going to be very noisy and be held hostage by reactions to the treasury markets and the yield coming out of there. If we can break above the 4000 handle, then the market is likely to go looking towards the 4100 level. In general, this is a market that has been in an uptrend, but the most recent rally was a little less impressive as far as a momentum measure is concerned. Once we get through the congressional testimony of Janet Yellen on Wednesday, we will probably have more clarity.