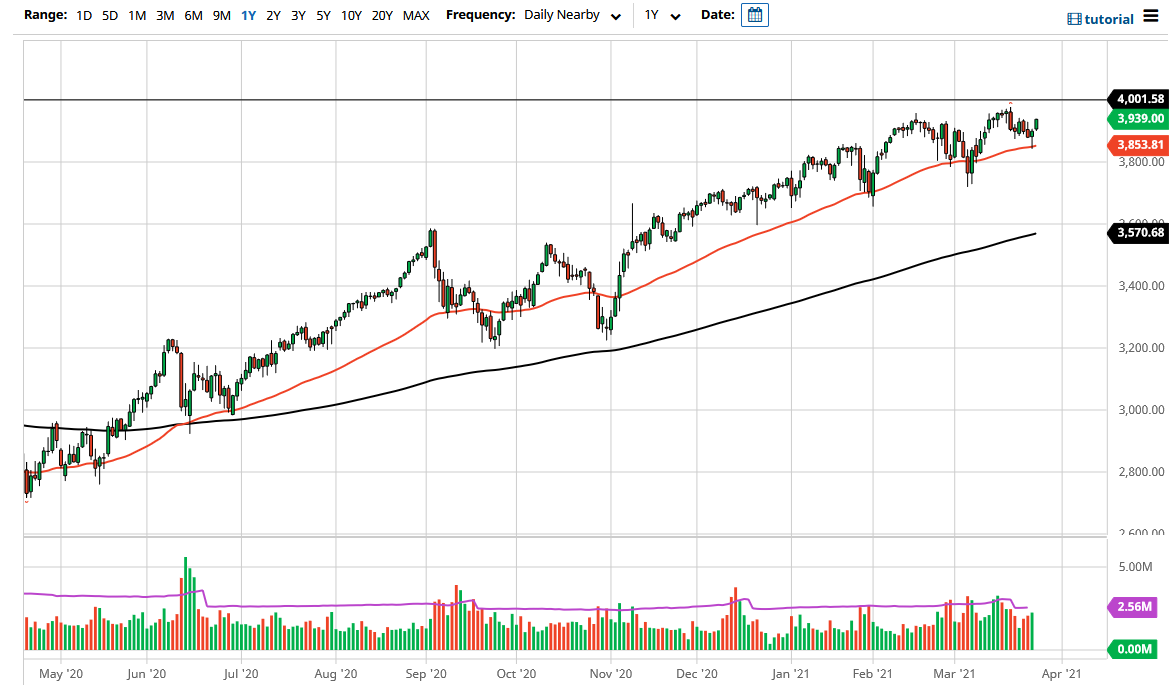

The S&P 500 gapped higher to kick off the Friday session, and then simply went straight up in the air. That is a very bullish sign, as we had formed a hammer from the previous session. Furthermore, that hammer bounced from the 50-day EMA and we are in an uptrend, so everything lines up for a move higher.

The candlestick is closing towards the top of the range, so that is a bullish sign as well. It is not necessarily a huge candlestick, but at least it gives us the impression that it wants to go higher from here. The 4000 handle would be a massive resistance barrier, but given enough time, I do think that we will poke above it. These large, round, psychologically significant figures tend to be very closely followed, and therefore it is an area where I think a lot of options barriers will be found. Nonetheless, I think after a few attempts we will finally break through there.

Underneath, the 50-day EMA obviously offers quite a bit of support, as the market has bounced from there multiple times. By doing so, it gives us a little bit of a “dynamic trendline” that we can follow. I think every time we pull back from here, there will be plenty of buyers willing to jump in and pick up bits and pieces of value. The yields in the 10-year note have calmed down quite a bit, which also helps Wall Street get bullish again.

Initial jobless claims have surprised this week, and that is a sign that perhaps the consumer will be coming back. This helps with the idea of spending in America, and boosting profits for corporate America. We also have seen the University of Michigan Consumer Sentiment numbers come out better than anticipated, so these are both good signs for profits in the United States. The S&P 500 is a broad enough index that I think will be somewhat insulated to some of the volatility that we have seen, as the VIX drops and traders are looking for value. Dips continue to be bought and that is exactly how I would play this market. I have no interest in shorting anytime soon.