The S&P 500 initially tried to rally during the trading session on Thursday, but as yields continue to play havoc with the stock market, we have seen a complete reversal. This should not be a major surprise, because the only thing people have seemingly been willing to pay attention to over the last couple of days has in fact been the 10-year yield, so it will be interesting to see whether or not that yield spiking yet again will continue to see a selloff.

It does not really matter for the Friday session though, because you should not be involved in the S&P 500 on what is known as “quad witching Friday.” This is when four separate options markets have quarterly expirations at the same time. This causes massive amounts of volatility in the markets and therefore can cost you quite a bit of money due to ridiculous moves of people squaring larger positions.

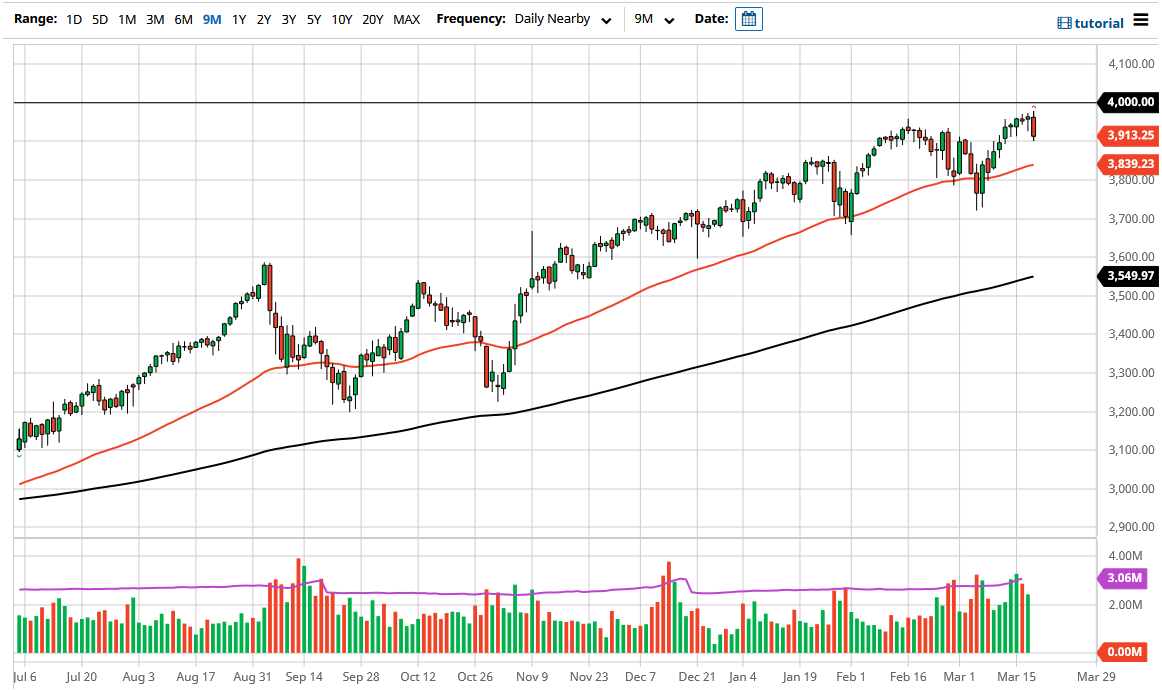

For what it is worth, we fell directly to the 3900 level, an area that is a large, round, psychologically significant figure, and should attract a certain amount of attention in and of itself. That being the case, I think that the market is probably going to look towards the area for some type of support, but if we break down below there then we will reach out towards the 50-day EMA underneath. That is sitting at the 3839 level, so a break down below there almost certainly opens up the move to 3800.

Regardless, I think the stock markets have gotten a little bit complacent as of late, so I think that this candlestick could lead to a short-term pullback, mainly due to the fact that bond yields in America are almost certainly going to go higher and as a result there is still quite a bit of adjustment left to do when it comes to risk appetite. Nonetheless, once we get through this Friday, I think that the next target will be 4000 unless something changes quite drastically with the overall outlook. Looking at the chart, it is only a matter of time before we continue the overall uptrend, but I anticipate it is probably going to be easier to deal with on Monday than it will during the day on Friday, because of all the excess noise.