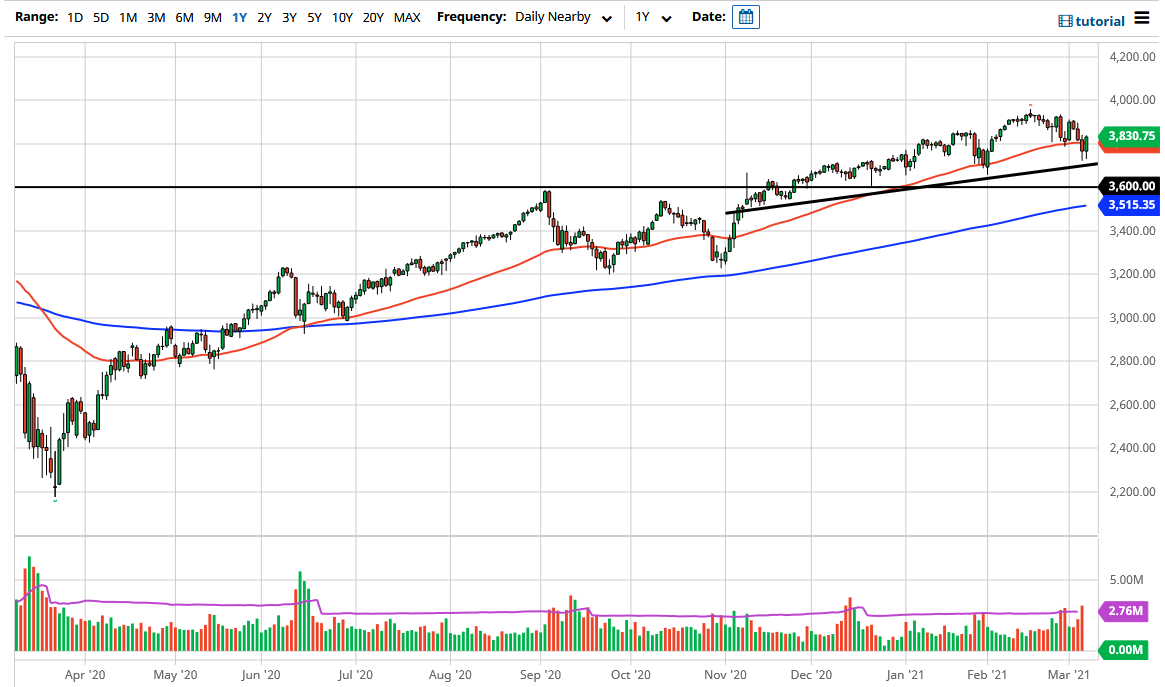

The S&P 500 initially fell during the trading session on Monday, but after the stronger-than-anticipated jobs number, the market rallied enough to go looking towards the 50-day EMA and even broke above it. The market looks as if it is going to continue to go higher. I believe that given enough time, we will go looking towards the 4000 handle, which is my longer-term target based upon the previous consolidation between 3200 on the bottom, and 3600 on the top. Adding 400 points to the breakout gives you the measured move to the 4000 handle. Furthermore, the 4000 handle is a large, round, psychologically significant figure that a lot of people would be looking to reach.

The uptrend line underneath should be rather supportive still, but if we were to break down below that, I would have no interest whatsoever in shorting this market. This is because I see the 3600 level as being supportive due to the fact that it was previous resistance. Market memory should come into play, and the round figure of the 3600 level also has its own part of play. After that, the 200-day EMA is sitting at the 3515 handle and approaching the 3600 level as well.

The candlestick itself was rather impressive, as the “real body” has closed at the very top, which suggests that there is still plenty of buying pressure. I do not think it is going to be that difficult to get to the 4000 level, but it will probably take some time. I like the idea of buying dips going forward, which is the general attitude of all stock markets that I follow, not just this one. As long as the Federal Reserve is going to keep credit easy, it is hard to imagine a scenario where the stock market falls apart, unless we have some type of massive spike in interest rates that gets out of control. I do not see that happening, although we have seen quite a bit of a push higher as of late. Unless it gets out of control though, I think the stock market will simply go higher based upon the idea of the economy reopening and causing a massive GDP spike as well.