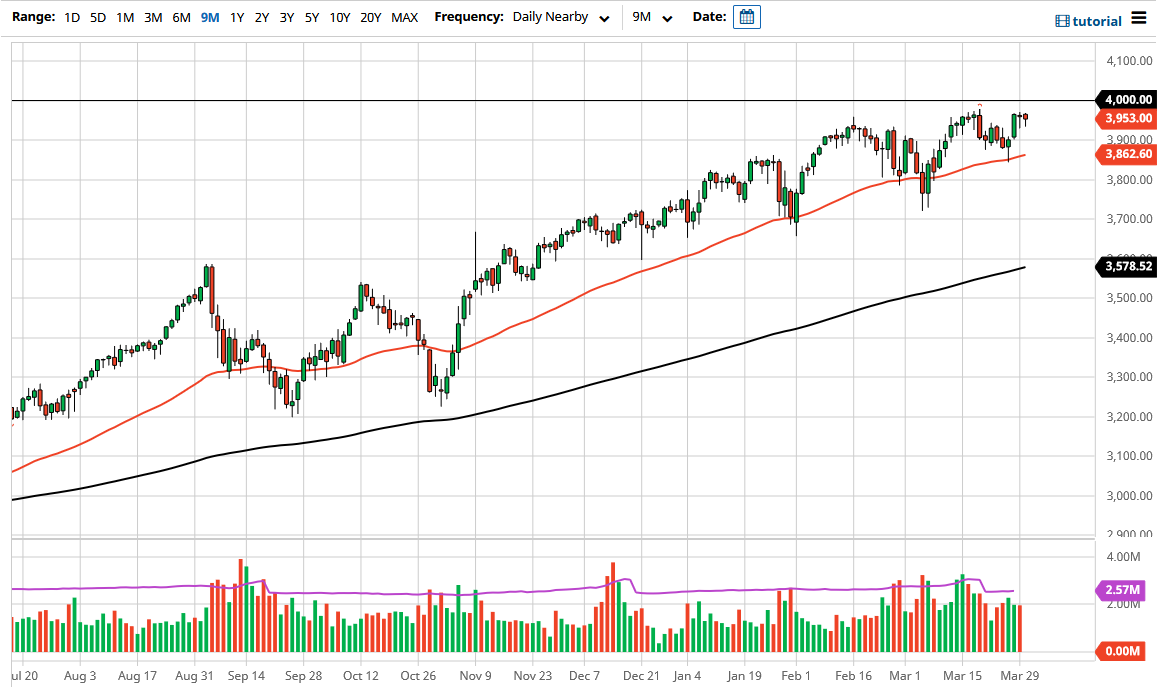

The S&P 500 continues to show signs of noise in general, and it now looks like the market is going to be a “buy on the dips” type of scenario every time it happens. The candlestick is a bit of a hammer shaped, which coincides with the hammer from the previous session. This shows that there are plenty of buyers underneath, so as we had seen a move higher before that, I think it only takes a little bit of imagination to suggest that we are going to continue to reach towards the 4000 level.

The 4000 level of course is a large, round, psychologically significant figure, and I think it is going to take quite a bit of effort to finally get through there. If and when we do, I believe that we probably go looking towards the 4100 level. In the meantime, I believe that short-term pullbacks will continue to offer value the people are willing to take advantage of. The 3900 level underneath would of course be a large, round, psychologically significant figure that a lot of people will be paying attention to.

Even below that area, I think there will be plenty of buyers at the 50 day EMA and then again at the 3800 level. The market continues to find plenty of reasons to go long, based upon valuations and the most recent story about the opening trade will continue to be a major influence on this market. Because of this, the market will eventually break out, and I think at this point most traders fully anticipate that happening. I do not short this market but if we were to break down below the 3800 level, I might be a buyer of puts.

The trend is starting to slow down a bit, but that is not a huge surprise considering that the market has been so resilient, and perhaps needs to take a bit of a break. Having said that, we are still bullish nonetheless, because the buyers of course continue to return. The market allows for short-term buying opportunities, so that is essentially what we have to look at as the most likely of traits going forward. With that in mind, I anticipate that once we get that rebalancing and quarterly inflows during the trading session on Wednesday, we may make a serious run higher.