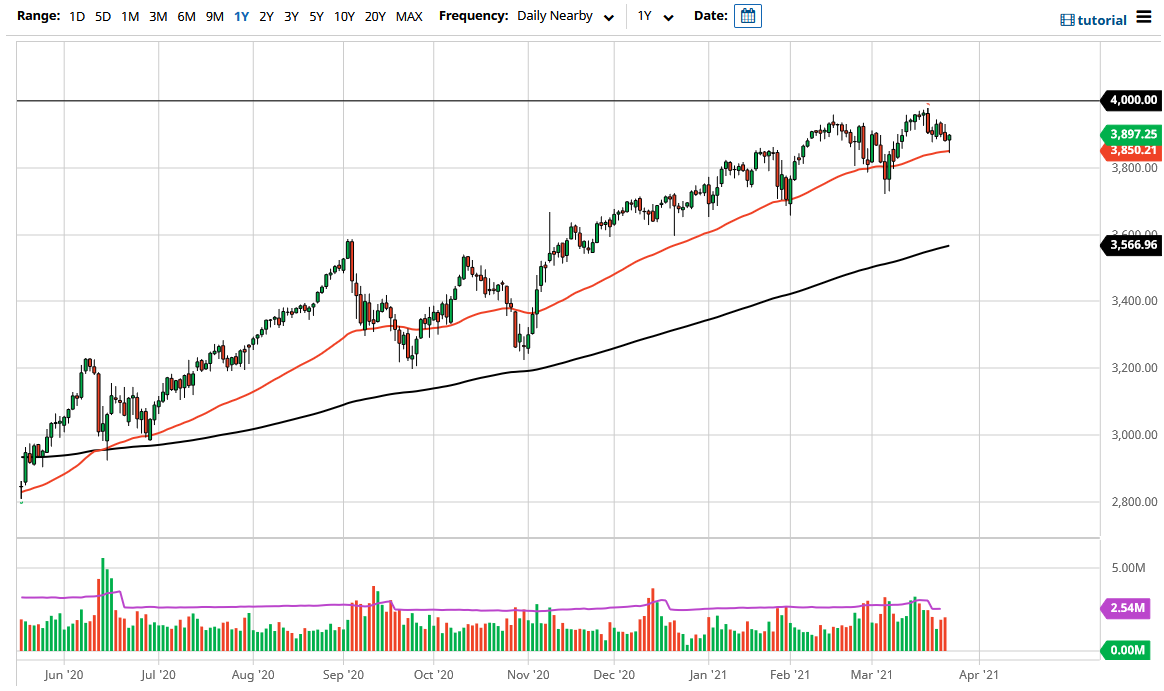

The S&P 500 initially fell during trading on Thursday to reach down towards the 3850 handle, which is where the 50 day EMA currently resides. We have bounced quite nicely from that area, forming a bit of a hammer which of course is a good sign and could send this market looking to the upside. That being said, I believe that this is a market that still has a lot to worry about, not the least of which would be interest rates climbing. However, there are a lot of concerns about whether or not the economy is going to take off like once projected.

The S&P 500 might be in a slightly different situation though, mainly due to the fact that the United States is in a better economic condition than many of the other major counterparts. The vaccine has been distributed throughout the United States rather efficiently, which is a sharp contrast to what we have seen in places like Germany and France. In fact, the European Union continues to see lockdowns, while the United States is opening. As long as that is going to be the case, one would have to think at the very least the S&P 500 should be a relative outperformer.

When it comes to American indices, I think this one outperforms most of the other ones due to the fact that it is much more diverse. Small companies in the Russell 2000 may struggle a bit, but they will eventually see buyers come back in based upon the reopening trade. The NASDAQ 100 is going to struggle due to the fact that growth companies will struggle with higher interest rate opportunities.

All that being said, I do think that the market is going to try to get to the 4000 level sooner or later, which of course is a large, round, psychologically significant figure that will attract a lot of attention. With that being the case, I think that we have a serious fight in that general vicinity. That being said though, the market is still very much in an uptrend, so the idea of the S&P 500 climbing is not exactly a major stretch of the imagination. If we do break down below the 3800 level, then we may have a little bit more of a correction but right now it looks like we are trying to rally again.