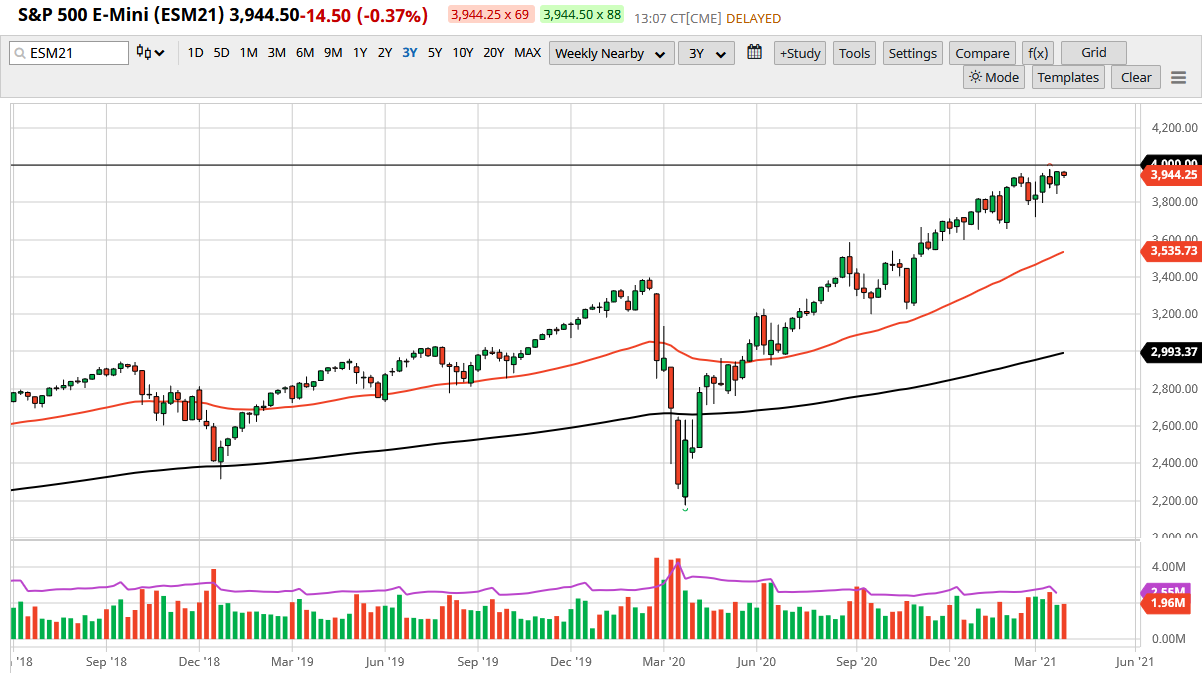

The S&P 500 has been slightly positive during the course of the month, using the 3800 level as a floor and the 3950 level as resistance. At this point, it certainly looks as if the market is trying to go higher, despite the fact that we have seen higher rates in America. It is those higher rates that have been a bit of a thorn in the side, as traders worry about whether or not risk appetite will still be the same as it has been. However, one of the most striking things about this price action has been that no matter what, the market continues to go higher.

The 4000 level above is a major barrier from a psychological standpoint, and of course there will be a lot of options exercised in that general vicinity. Ultimately, that is going to be a bit of a barrier and of course we have a certain amount of headline risk once we get to that area. With that being the case, I think it is going to be difficult to get above there. Notice I did not say that it was going to be impossible. I do recognize and sooner or later we will have some type of catalyst to break out.

Another thing to pay attention to is the fact that the Tuesday session was the end of the quarter, and there would be a significant amount of rebalancing to be done. With that in mind, we have seen a little bit of volatility on top of the volatility of risk appetite all over the place in the bond markets. Nonetheless, I think that the 3800 level will be supportive, just as the 3700 level will be.

Sometime during the month of April, I fully anticipate that we will see a daily close well above the 4000 level that opens up fresh buying. In fact, I anticipate that it will be a relatively early event in the month before we continue to go higher. We have been consolidating for a while, so I think that it makes sense that we will continue to look at pullbacks as potential buying opportunities and of course build up enough pressure to finally take off. Most recent large candles are all green, so that tells me there is still more buyers than sellers on the whole.