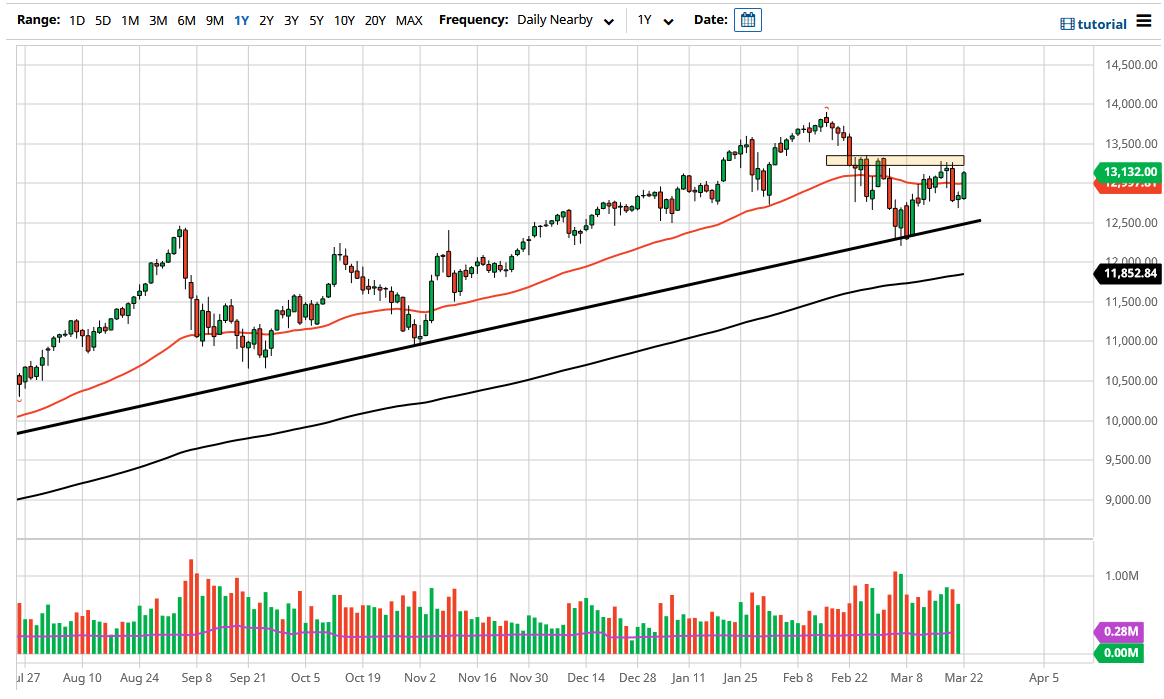

The NASDAQ 100 had a very strong trading session on Monday as we have broken back above the 50 day EMA yet again. In fact, this is something that should not be a massive surprise, considering we form such a nice hammer on Friday which of course was “quadruple witching” in America, meaning that four different options market had quarterly expiration at the same time.

Looking at this chart, I think that there is a significant barrier at the 13,333 level, which we have seen pushback more than once. If we can break above there, then it is likely that we will continue to go higher, perhaps trying to reach towards the highs again. However, if we cannot break above that level then I think the uptrend might be in a bit of trouble, at least from the short-term standpoint.

The NASDAQ 100 is comprised of major technology companies, so that of course has a lot to do with what we are seen. We have seen a recovery in several of the big names and that has a significant outsized effect on this index. Regardless, with the 10 year yields dropping a bit during the trading session on Monday, with no big surprise to see that this market would get a bit of a reprieve. However, I am still a bit cautious when it comes to this market due to what we have seen on Thursday, as it has been massive in its negative connotations. However, there is still a significant amount of support underneath in the form of the uptrend line, so I think that the 12,500 level will be crucial. If we were to break down below that level, then things could get ugly rather quickly. I would not be a seller that point though, I would be looking at the options market in order to buy a put because it is far too dangerous to short the market these days. One thing that is interesting though is that we could be forming a “lower high” if we do not break above the previously mentioned 13,333 level. If that is the case, that would be negative and of course could have a lot of people out there concerned. Longer-term though, we have been in an uptrend and it has been very difficult to short this market over the last several years.