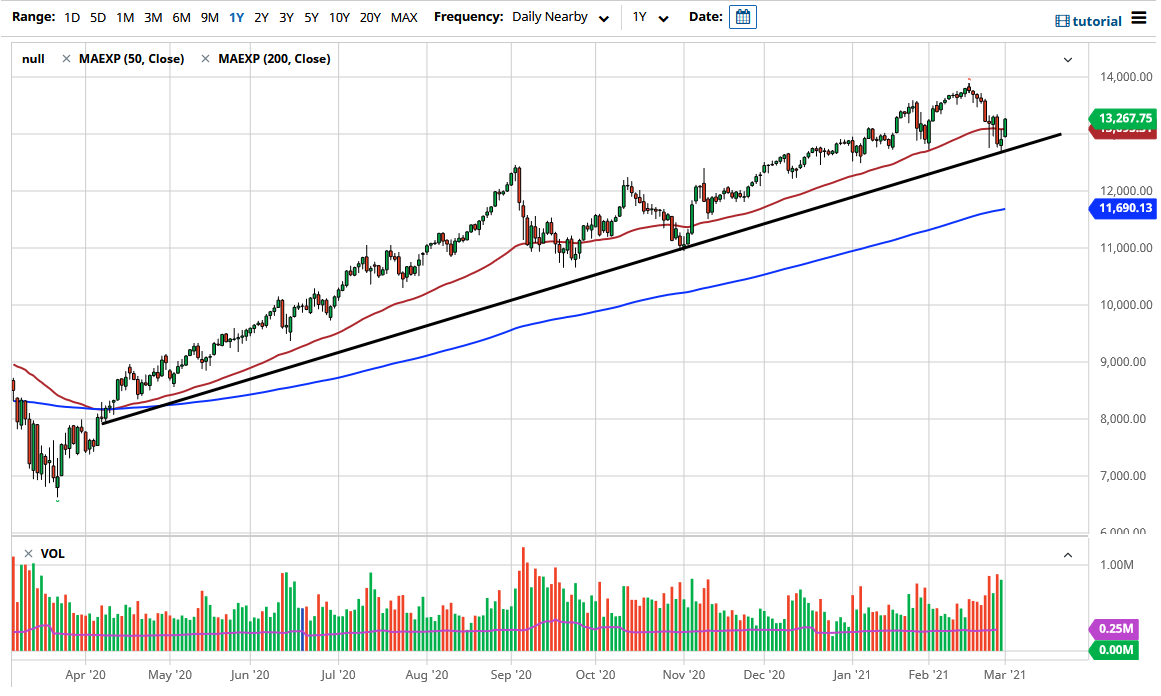

The NASDAQ 100 rallied significantly during the trading session on Monday to gain 2.75%. This is a very bullish move, and one that was a little bit surprising. We have seen the inverted hammer from the Friday session get broken above, and now it looks as if the market is setting its sights on the 13,340 region, which has been resistance over the last 4 or 5 candlesticks. The 50-day EMA is flat and slicing right through the middle of the candlestick for the Monday session, so I suppose it is worth noting that maybe the market looks a little tired at this point.

We could get a little bit of a pullback, so if we were to reach down towards the 13,000 level, I anticipate that there would be a lot of buying pressure. After that, you then have the uptrend line that has been such a prominent part of the market recently. On the other hand, if we were to break above the 13,348 level, then it opens up a move towards the 13,600 level, followed by the highs again. I do think that eventually we will go looking towards the highs, which is essentially the 14,000 level. Furthermore, I believe that the market is going to go looking towards the 15,000 level.

Recently, we have seen a lot of concern about yields in the United States rising, but as long as the rate of change is not overly rapid, both yields and stocks can go up at the same time, despite what you may or may not have heard. The size of the candlestick for the trading session is rather impressive, and the fact that we are closing at the very top of it is typically a sign that you will see a bit of follow-through. In fact, I think it is only a matter of time before dips attract plenty of buyers to get involved in this market, and it is not until we break down below the inverted hammer, roughly the 12,700 level that I would be concerned. At that point, I think it would open up a possible move down to the 12,000 handle. The 200-day EMA is also starting to reach towards that area as well, which would be the next major support level.