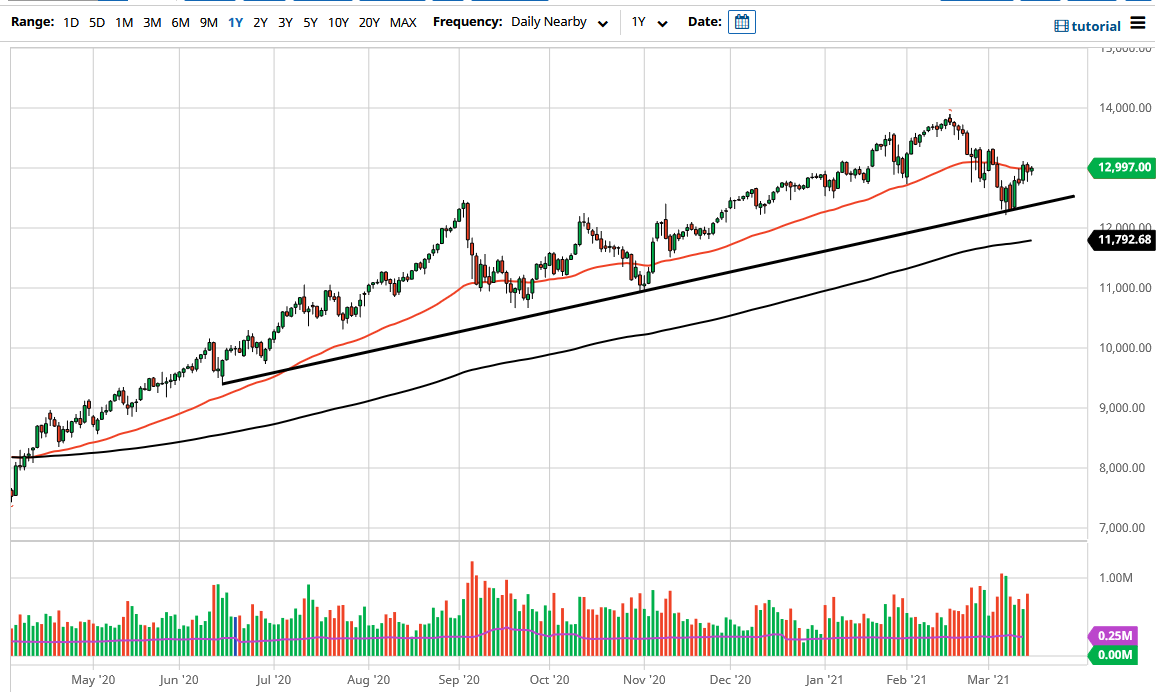

The NASDAQ 100 has gone back and forth during the course of the trading session on Monday, as we continue to hang around the 13,000 level. The 50 day EMA is slicing through the candlestick right now, and it does suggest that perhaps trend traders are trying to figure out what to do next. This is going to be especially true considering the fact that the market has been paying close attention to yields in America, and if they start to drop that should help equities overall. At this point time, the market is likely to see a lot of attention paid to the statement at the FOMC meeting on Wednesday, and of course the question and answer session afterward.

To the downside, we have a nice uptrend line that should come into play, right around the 12,500 level. Underneath there, then we could be looking at the 12,000 handle which is now backed up by the 200 day EMA. To the upside, we have the 13,333 level that has offered resistance recently, you know if we were to turn around a break above there it is likely that the market could go looking towards the 14,000 handle. The 14,000 level of course is a large, round, psychologically significant figure and of course an area that we have seen a significant pullback from.

The 50 day EMA is essentially flat at this point, but if we can turn around a break to the upside, then the 50 day EMA should start to turn higher and that will help the idea of longer-term investors coming into pick up the NASDAQ 100. That being said, the NASDAQ 100 has the specter of being a technology index, and that of course is an area that has been beaten down by the higher rates.

In general, I think over the next couple of days you will see a lot of choppiness, and it seems as if the behavior will continue to be an issue. That being said, I think that if we can continue to see yields keep from spiking, we will eventually see a push higher. After all, the Federal Reserve is not going to let markets get out of control, so if we do get a major plunge lower, at that point I would be looking for stabilization so I can get long again.