The NASDAQ 100 got hammered on Thursday as bond yields in America spiked quite drastically. With the 10-year hitting as high as 1.75% during the session, the stock markets suffered as a result. After all, it is difficult to imagine a scenario where the markets could get away from such a massive move in the bond markets. The NASDAQ 100 is especially vulnerable to this type of action due to the fact that there are so many technologically heavy companies in the index.

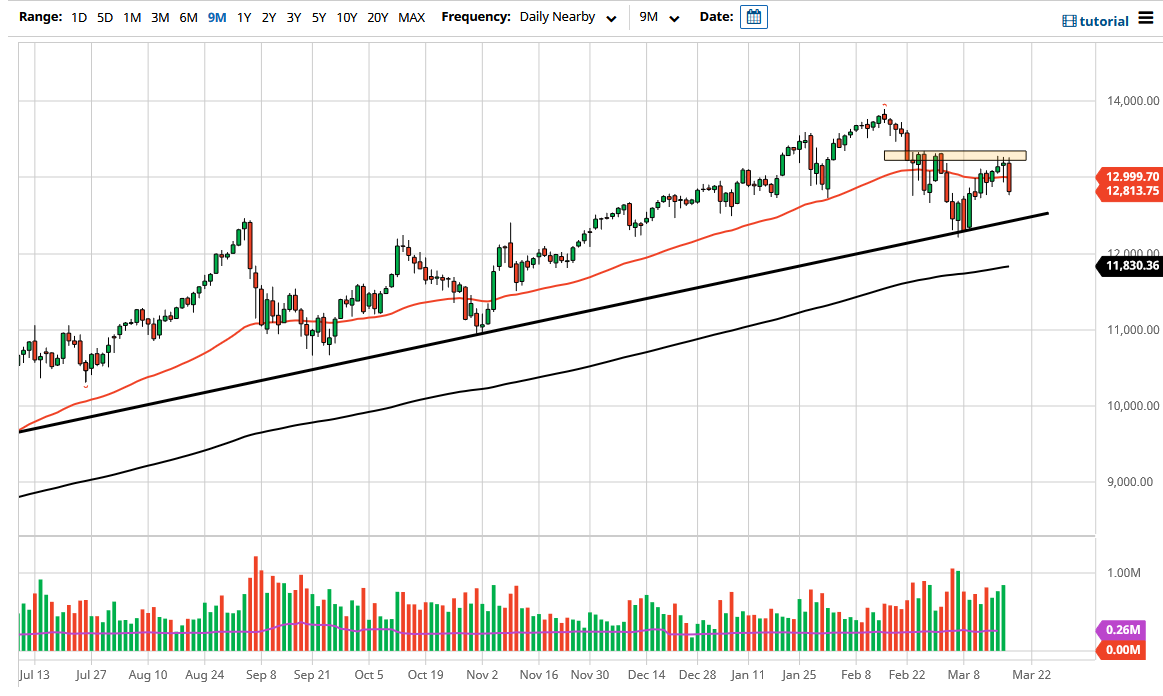

Regardless, we are still very much in an uptrend, as we have a nice uptrend line just below that should offer support, so I think that this will end up being a bit of a pullback that a lot of traders will be looking to take advantage of. If they get that chance, they will almost certainly be buyers, as the market will look to find some type of stabilization. After all, the yields in the bond markets are rising due to good factors, meaning that the economy is actually growing, something that has surprised a lot of traders as to the speed of the recovery.

While I do believe that the NASDAQ 100 will lag other indices going forward, the reality is that it still should be somewhat bullish. Nonetheless, we have to worry about the overall effect on traders when it comes to these bond yields, so I think you need to be very small with your position size. Furthermore, it is also quad witching Friday, which means that four major asset classes have options that are expiring during the day. This causes massive amounts of volatility as well, so I think Friday is probably a day that is going to be really good for losing money if you are not careful. Because of this, I will be trading this index, but I will be paying close attention to whether or not we can break above the 13,333 level, or if we hang onto the uptrend line underneath that has been so important. With that being said, I am on the sidelines, but I recognize that by the end of the day Friday we may have a little bit more clarity that we can work with and take advantage of on Monday when we get back to work next week.