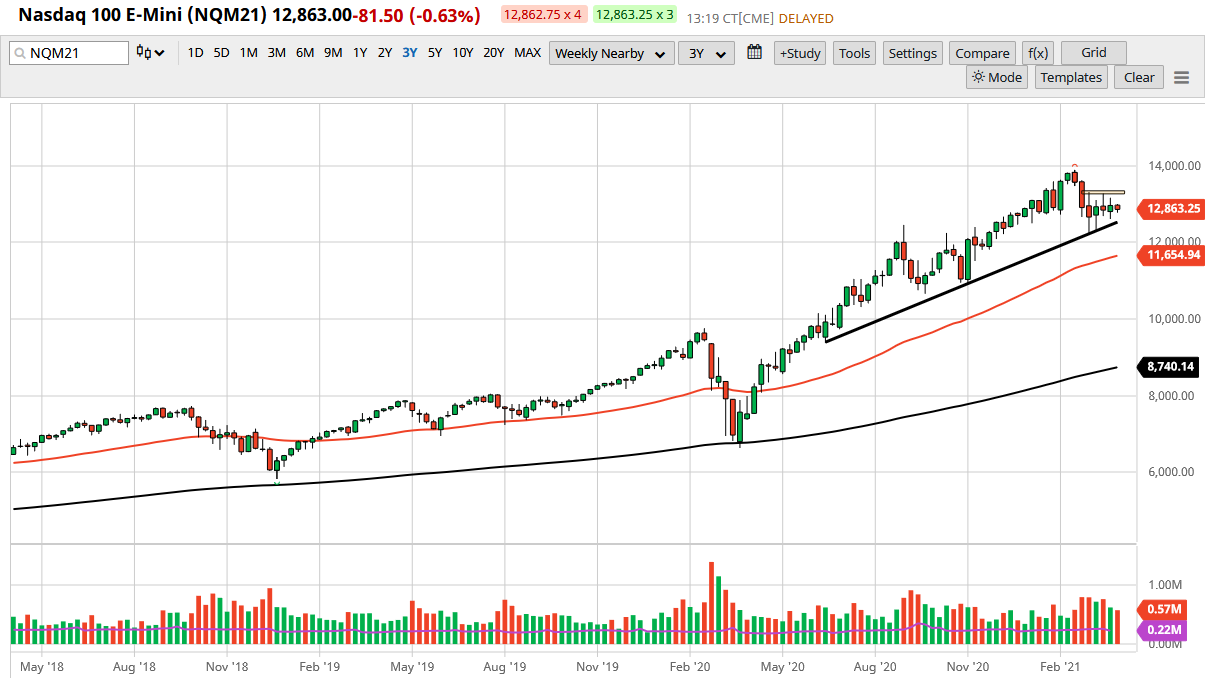

The NASDAQ 100 has gone back and forth during the course of the month in March and it now looks as if we are trying to build up enough momentum to finally break out to the upside. I look at the 13,333 level as a resistance barrier that if we can get above, then it is likely that the market is going to go looking towards the 14,000 handle, and then possibly the 15,000 level after that.

There is a significant uptrend line underneath that should continue to come into play, and we are getting close to that area, so I think it is only a matter of time before the buyers come in. Even if we did break down below that uptrend line, it is possible that we could go towards the 12,000 level where we would see even more buyers. The 50 week EMA is sitting just underneath there, and it is trying to reach higher. In general, the NASDAQ 100 has been suffering at the hands of higher interest rates, which the rate of change has been rather rapidly.

All things been equal, I have no interest in shorting the NASDAQ 100, but I also recognize that the NASDAQ 100 will probably lag other indices in the United States, as those highflying tech companies will continue to be a bit soft. In general, this is a market that I think will eventually be pulled higher by the idea of the economy opening up in the United States in a much faster clip than many other parts of the world.

If you are looking for some type of preliminary signal, you can pay close attention to the KOSPI in South Korea, as it is heavily influenced by technology companies as well and does tend to lead the NASDAQ 100 overall. It has been trying to turn around and continue in an uptrend, so that might be a little bit of signal in this market as well. At this point, I do believe that sometime during the month we will break above the 13,333 level and go looking towards the highs. The market breaking down from here could offer a put buying opportunity, but really at this point in time it does not seem to be very likely that any breakdown would last more than a few weeks.