Gold has so far been unable to compensate for its sharp losses during last week’s trading. With the beginning of this week's trading, the price of gold tried to rebound higher, reaching the resistance level at $1760, then fell this morning to the $1707 support before settling around $1720 as of this writing. Gold prices fell as investors rushed to buy riskier assets amid some optimistic economic data, the US House of Representatives passed a $1.9 trillion coronavirus relief package, and there have been positive developments regarding vaccines.

As equity indices rose, the Dow Jones, NASDAQ and S&P rose 2.4%, 2.7% and 3%, respectively. The rise in the dollar also affected the yellow metal. Accordingly, the US Dollar Index rose to 91.14.

Silver futures closed at $26,678 an ounce, while copper futures settled at $4,130 a pound.

The Institute of Supply Management released a report showing US manufacturing activity grew at an accelerating rate in February. The ISM said that the Manufacturing PMI rose to a reading of 60.8 in February from a reading of 58.7 in January, and according to the index data, any reading above the 50 level indicates growth in the manufacturing sector. Economists had expected the index to reach a reading of 58.8 points.

A separate report by the Commerce Department showed that construction spending in the US increased by much more than expected in January. The US Commerce Department said construction spending rose 1.7% to an annual rate of $1.522 trillion in January after jumping 1.1% to a revised rate of $1.497 trillion in December. Economists had expected construction spending to rise 0.8%.

Despite an economy that suffered setbacks nearly a year ago due to the coronavirus pandemic, historically low interest rates and urban residents looking for more space in the suburbs and beyond have boosted home sales. Last week, the Commerce Department reported that US new home sales jumped 4.3% in January, 19.3% higher than last year at this time.

In a separate report, the government stated that building permit applications, which usually indicate future activity, rose 10.4% in January. Spending on government projects, which were constrained by tight government and local budgets in the wake of the epidemic, increased by 1.7%. Non-residential construction rose 0.4% after months of downturn, but is still down 10% from January of last year. The hospitality category also increased by 0.7%, but it is still down by 22.7% compared to the same period last year, as the travel and entertainment sector was one of the sectors most affected by the epidemic.

US construction spending in January totaled $1.52 billion, up 5.8% from January 2020.

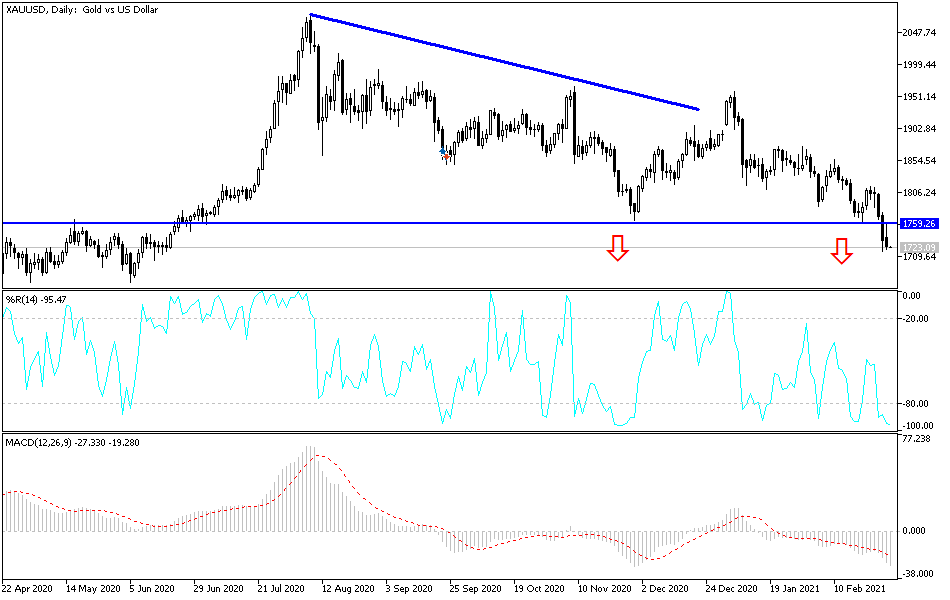

Technical analysis of gold:

On the daily chart, gold's recent losses have moved the technical indicators to strong oversold levels, so the most important buying levels for gold in the near and medium term may be $1710, $1685 and $1660, which could be the technical starting point for reversing the bearish outlook. In general, the bulls will not gain control over the performance of the gold price without breaching the psychological resistance level at $1800.

I still prefer to buy gold from every dip.

The price of gold will be affected today by the strength of the US dollar, the extent of investor risk appetite and the halting of bond yields. It will also be affected by the announcement of the Bank of Australia's monetary policy, European inflation figures and statements by officials from the US Federal Reserve.