The continued strength of the US dollar and bond yield gains contributed to the collapse of the price of gold to the $1679 support level before stabilizing around $1685. So far the bears' dominance is still the strongest. Investors abandoned gold as well, as optimism about the strong economic recovery of the United States of America amid the momentum in vaccinations and the reopening of companies weakened the demand for the safe-haven mineral.

The US Dollar Index (DXY) jumped to 93.35 and the yield on the 10-year US Treasury note rose to a 14-month high of around 1.778% before easing slightly. In the same performance as gold, silver futures contracted at $24.137 an ounce, while copper futures settled at $3.9785 a pound.

Consumer confidence in the US rose by much more than expected in March, with the index coming in at 109.7 in March from a downwardly revised 90.4 in February. Economists had expected the Consumer Confidence Index to rise to 96.0 from the 91.3 originally announced for the previous month. With a much larger increase than expected, the Consumer Confidence Index reached its highest level since the outbreak of the coronavirus pandemic in March 2020.

Commenting on the results, Lynn Franco, Director of Benchmarks at the Conference Board, said that the marked improvement in the index and its main components was a good sign of future economic growth. "Consumers' renewed optimism has boosted their buying intentions for homes, cars and many other expensive goods," she said. But she indicated that concerns about inflation have also risen, most likely due to higher gasoline prices, and that this could ease spending in the coming months.

Therefore, most economists expect strong growth in the United States in the coming quarters, supported by rising consumer confidence and consumer spending, which represents 70% of US economic activity.

More than 95 million people, or 28.6% of the US population, have received at least one dose of the coronavirus vaccine, according to the Centers for Disease Control and Prevention. Accordingly, about 52.6 million people, or 15.8% of the population, have completed their vaccination. As for cases, the seven-day rolling average of daily new cases in the United States over the past two weeks rose from 55,332 on March 15th to 65,789 on Monday, according to Johns Hopkins University.

The seven-day rolling average of new daily deaths in the US over the past two weeks has fallen from 1,364 on March 15th to 989 on Monday, according to Johns Hopkins University.

The United States of America and more than a dozen other countries have expressed their concerns about a study conducted by the World Health Organization on the potential origins of the virus in China, noting the delay and the inability to access samples and data. Accordingly, a joint study by the World Health Organization and China on the origins of COVID-19, published yesterday, says that the transmission of the coronavirus from bats to humans through another animal is the most likely scenario and that an epidemic leakage from a Chinese laboratory is "extremely unlikely". The report called for further study, and therefore the head of the World Health Organization said that all the hypotheses are still open.

After the study was released, the Ministry of Foreign Affairs said that 14 countries are calling for "momentum" to take a look at the second stage by experts, and indicated the need for more studies on animals "to find means that contributed to the transmission of the virus to humans."

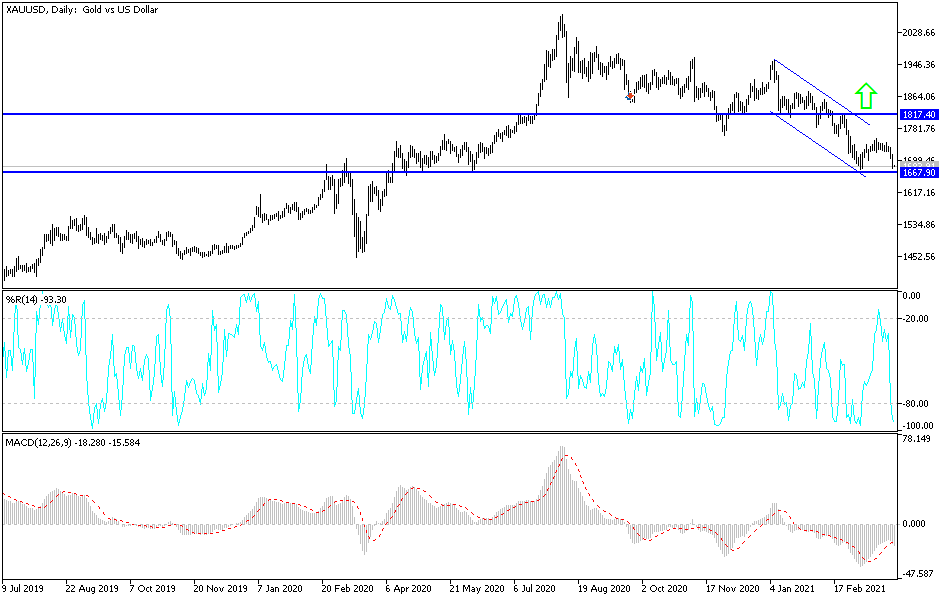

Technical analysis of gold:

The strong bearish breakouts recently pushed the technical indicators, as is evident on the daily chart below, to strong oversold levels. The price of gold today is within a decisive trading session. As for a higher correction, which is currently anticipated by gold investors who are thinking of taking advantage of the recent decline to short gold, the support levels of $1678, $1660 and $1645 may be the most appropriate to do so.

If there are negative reactions to the dollar and the bond market, the bulls may have a better opportunity to prepare to move towards the level of psychological resistance at $ 1,800, which is of great importance to change the current bearish outlook. I still prefer to buy gold from every downside.

The price of gold will be affected today by the strength of the dollar, the reaction to the announcement of Biden's plans, the reaction to the release of economic data, the growth of the British economy, inflation in the Eurozone and the ADP reading of US non-farm payrolls.