Gold futures closed yesterday's trading session higher, supported by the stalling of the US dollar's gains and stabilization of government bond returns. The gains in the price of gold reached the level of $1726 at the time of writing, as a reversal from strong selling that pushed it towards the support level of $1677 dollars, its lowest in 10 months at the beginning of this week's trading. Data showing a modest increase in US inflation had affected gold prices, but safe-haven assets trimmed losses to settle at a slight increase. During the Tuesday session, the price of gold jumped by a gain of $40 during that trading session, as US bond yields retreated from their recent dramatic rise, allowing the yellow metal to benefit again as investors hedge against price pressures.

Silver futures ended lower at $26,130 an ounce, while copper futures settled at $ 4.0325 a pound.

Data released by the US Labor Department showed that US consumer prices rose in line with economists’ estimates in February, jumping 0.4% month-on-month, after rising 0.3% in January. Now investors are watching the European Central Bank monetary policy announcement on Thursday. The bank is widely expected to ramp up its asset purchases in response to rising bond yields.

The yield on the 10-year US Treasury fell for the first time in six sessions, from its highest levels in the previous year of 1.6%. In general, since the start of trading in the new year 2021, the performance of the gold price has remained the worst, as it lost nearly 11% of its value before the end of the first quarter of this year. During 2020, it jumped to a historic peak, to $2075.

The US House of Representatives this week voted on a $1.9 trillion stimulus package bill. Amid optimism about the global economic recovery from COVID-19, the Organization for Economic Cooperation and Development expected a stronger recovery than the organization’s last forecast last December, as it expected global growth of 5.6% this year and a growth of 4.0% next year.

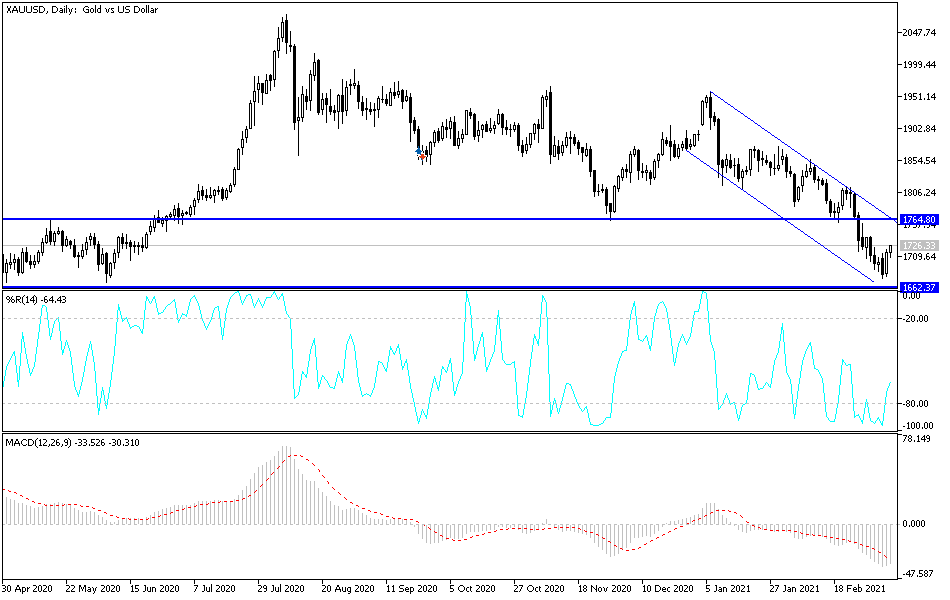

Technical analysis of gold:

Despite recent gains, the price of gold is still moving within a sharp downward channel according to the performance on the daily chart, and there will be no reversal of the current trend without first penetrating the highest psychological resistance at $1800. This will depend on the continued weakness of the US dollar and its declining yield on bonds. Currently, the closest resistance levels for gold are $1745, $1760 and $1775. On the downside, the return of stability below the level of $1700 will increase the control of the bears and prepare for stronger losses. I still prefer to buy gold from every downside.

The price of gold will be affected today by the strength of the dollar and the extent of investor risk appetite, as well as the reaction from the European Central Bank's announcement of its monetary policy decisions and the number of US jobless claims.