The price of gold has remained stable between the $1700 support level and the $1740 resistance level, waiting for enough momentum to move higher or resume recent downward pressure. The US dollar recovered, and it remained a barrier to the price of gold to launch strongly higher. The price of gold today stabilized around $1730 at the time of writing. Bond yields are still captivating the spotlight, especially ahead of an important meeting of the US Federal Reserve on Wednesday. Gold prices rose as the yield on long-term government bonds decreased slightly. However, the stronger dollar limited bullion price gains.

Silver futures rose at $26.288 an ounce. Copper futures were steady at $4.1405 a pound.

Investors are awaiting the Fed’s monetary policy announcement and the central bank’s views on the recent rise in bond yields will be the focus of attention.

A report from the Federal Reserve Bank of New York showed that the pace of growth in manufacturing activity in New York accelerated in March. The Federal Reserve Bank of New York said that its General Business Conditions Index rose to 17.4 in March from 12.1 in February, and any positive reading indicates growth in regional manufacturing activity. Economists had expected the index to rise to 14.5. Looking ahead, the Federal Reserve Bank of New York said companies were still optimistic that conditions would improve over the next six months, and expected significant increases in employment.

In terms of news out of China, data showed that Chinese industrial production jumped 35.1% year-on-year in the period including January and February - beating expectations of a 30% increase. Retail sales rose 33.8% year-on-year, exceeding expectations while investment growth was weaker than expected and high unemployment disappointed the markets.

A slew of European countries - including Germany, France, Italy and Spain - have stopped using AstraZeneca's COVID-19 vaccine due to reports of dangerous blood clots in some vaccine recipients, although the company and international regulators say there is no evidence that the dose caused it. AstraZeneca is one of three vaccines used on the continent. But the mounting anxiety is another setback for the European Union's vaccination campaign, which suffers from shortages and other hurdles and lags far behind campaigns in Britain and the United States.

The European Union Medicines Regulatory Agency has called a meeting on Thursday to review the experts' findings on the AstraZeneca dosage and determine whether action is needed. The noise comes as Europe tightens restrictions on schools and companies amid a rise in cases of coronavirus. For his part, the German Minister of Health said that the decision to suspend AstraZeneca doses was made based on the advice of the country's vaccine regulator, the Paul Ehrlich Institute, which called for further investigation into seven cases of clots in the brains of people who were vaccinated. “Today’s decision is a purely precautionary measure,” said Jens Spahn.

French President Emmanuel Macron said that his country would likewise stop administering the vaccine until at least Tuesday afternoon. Italy announced a temporary ban, as did Spain, Portugal and Slovenia. Other countries that have done so over the past few days include Denmark, which was the first, as well as Ireland, Thailand, the Netherlands, Norway, Iceland, Congo, and Bulgaria.

In the coming weeks, AstraZeneca is expected to apply for a permit from the United States for a vaccine. The United States now relies on Pfizer, Moderna, and Johnson & Johnson vaccines.

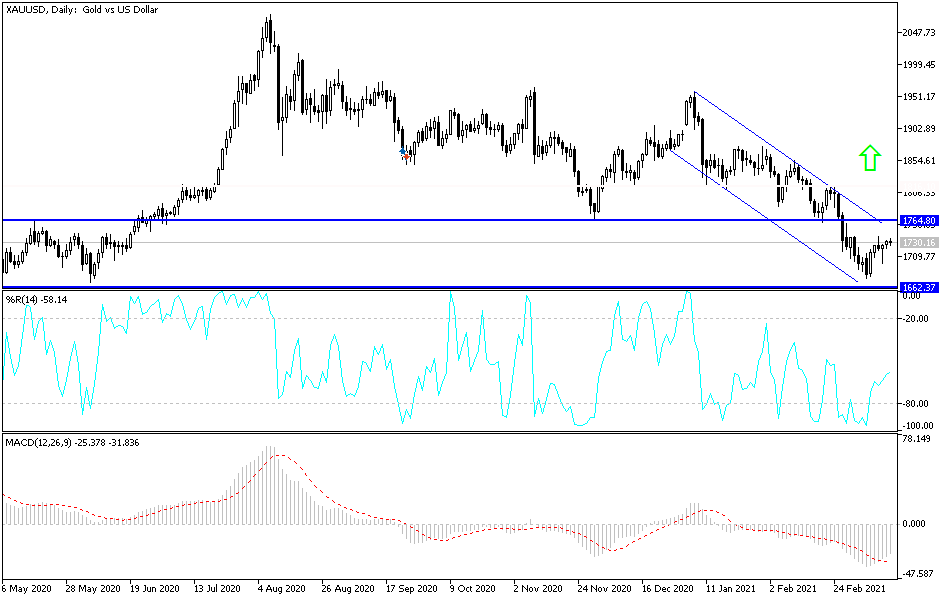

Technical analysis of gold:

I still see that any dip in the price of gold will be a buying opportunity. The closest support levels for gold are currently $1710, $1685 and $1660. On the upside, the bulls will still need to breach the $1,800 psychological resistance level to control performance for a longer period and thus increase buying.

Today's gold price will be affected by the strength of the US dollar and the reaction to the announcement of the German ZEW reading and US retail sales numbers.