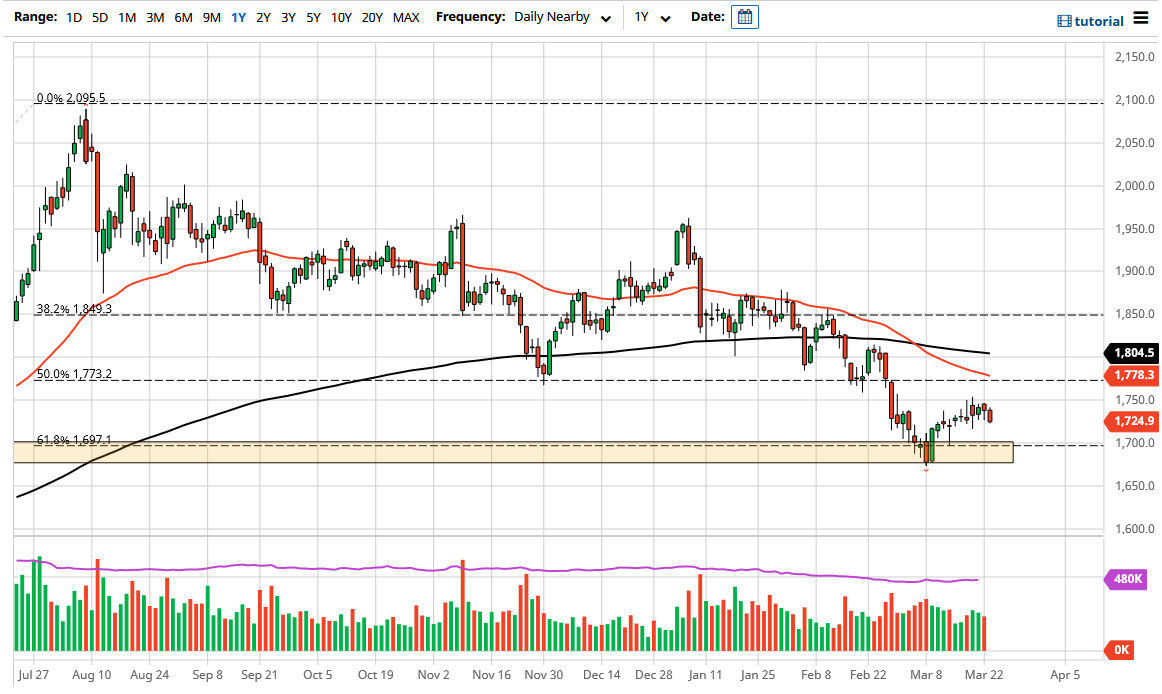

Gold markets have fallen a bit during the trading session on Tuesday, as we look likely to roll over and go looking towards the $1700 level again. That is an area that has been important more than once, and of course it is a large, round, psychologically significant figure that a lot of traders will be closely paying attention to. The 61.8% Fibonacci retracement level lines up there as well, and of course it had previously been resistance, which also lends itself to be potential support.

Keep in mind that the US dollar is going to continue to strengthen as long as rates do, so as long as those rates in the treasury markets continue to rise, that is going to be toxic for gold. With that in mind you have to pay attention to the bond markets in America and what the yields are doing. The 10 year note has been as high as 1.75% recently, and that of course is something that works against precious metals as you have to pay to store them. It is much easier to simply clip coupons and collect yield than it is to be bothered with handling physical gold. Paper gold is a completely different scenario, but at the end of the day it is all priced off of the same demand.

On the other hand, if we were to turn around and rally from here, it is likely that the $1750 level will be resistance, followed by the $1800 level. That does not mean that is going to be easy to make that move, but that would be the initial shot higher. If we break above the $1800 level, then I would believe some type of rally. Until then, I look at any rally from here as more than likely be an opportunity to sell gold yet again on shorter time frames, as the market has been down roughly 24% at the lows for the last several months.

If we break down below the bottom of the lows from a couple of weeks ago, we will make a “lower low”, and then open up a move down to the $1500 level. That is a pretty significant move, and I do think that it would also show a pickup in momentum, so on a fresh, new low I would not only be a seller of gold, but I would be aggressive about it.