Gold markets initially rallied during the trading session on Tuesday but could not hang on to gains as we anticipate the FOMC meeting and statement. After all, traders will be paying close attention to the words of Chairman Powell and what he has to say about the yield curve. Yields in the United States have been horrible for gold, and if the Federal Reserve is not willing to get involved and suppress those yields, gold will continue to struggle. This is exactly what we are waiting on, and whether or not the Federal Reserve does something will determine whether we turn things around for this market, or if we see a continuation of what has been the trend.

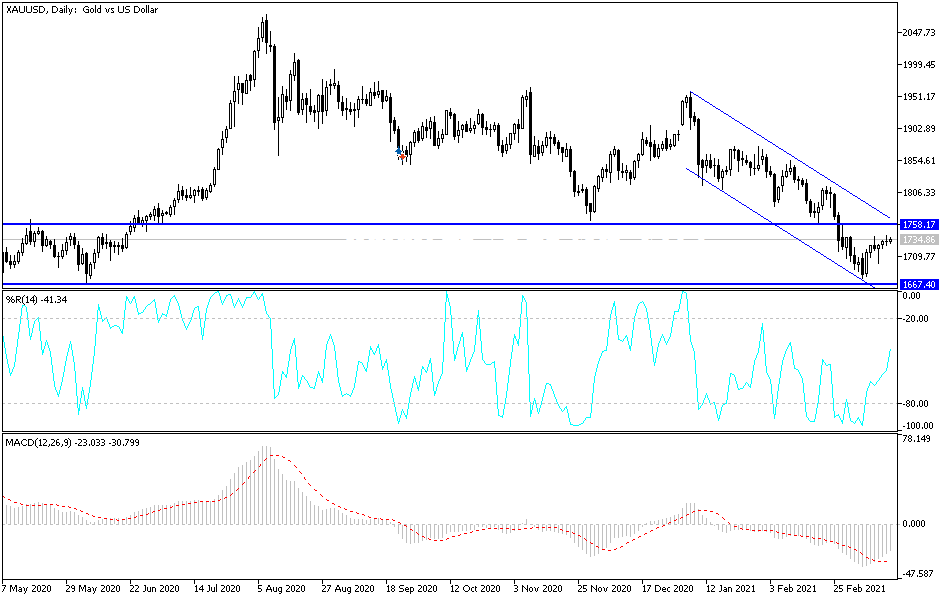

What is worth noting is that the $1700 level has offered support, and that is a large, round, psychologically significant figure. Furthermore, it is also where we find the 61.8% Fibonacci retracement level and had recently seen a lot of resistance. In other words, there is a lot of order flow in this area so it should continue to attract a potential buying crowd. If gold cannot hold itself together in this general vicinity, it is going to drop another couple of hundred dollars rather quickly.

If you believe in gold, then this is where you need it to hold up. If we break down below the lows of last week then it is very possible that we may go down to the $1500 level over the longer term. That is not my best-case scenario, but it is something that could happen rather quickly if the Federal Reserve is not going to do anything about bond yields, as gold tends to move in the opposite direction overall. As nominal yields continue to rise, traders can earn a safe return by clipping coupons instead of storing gold, which is a bit of a no-brainer.

To the upside, if we do break out, the 50-day EMA will be a target for the bullish traders, and then possibly even a move towards the $1850 level. At this juncture, I do believe that it is only a matter of time before we have to make a bigger decision, and I suspect it may be made somewhere around 4 PM Eastern Standard Time.