Gold markets initially fell during the course of the trading session on Monday but turned around to show signs of strength again. At this point, the market looks very likely to continue to see noisy behavior, due to the fact that the interest rates in America have been all over the place, and that of course has a major implication as to what happens with gold. The gold markets are directly negatively correlated to interest rates in the United States, and as a result the 10 year yield has scrapped a lot of headlines.

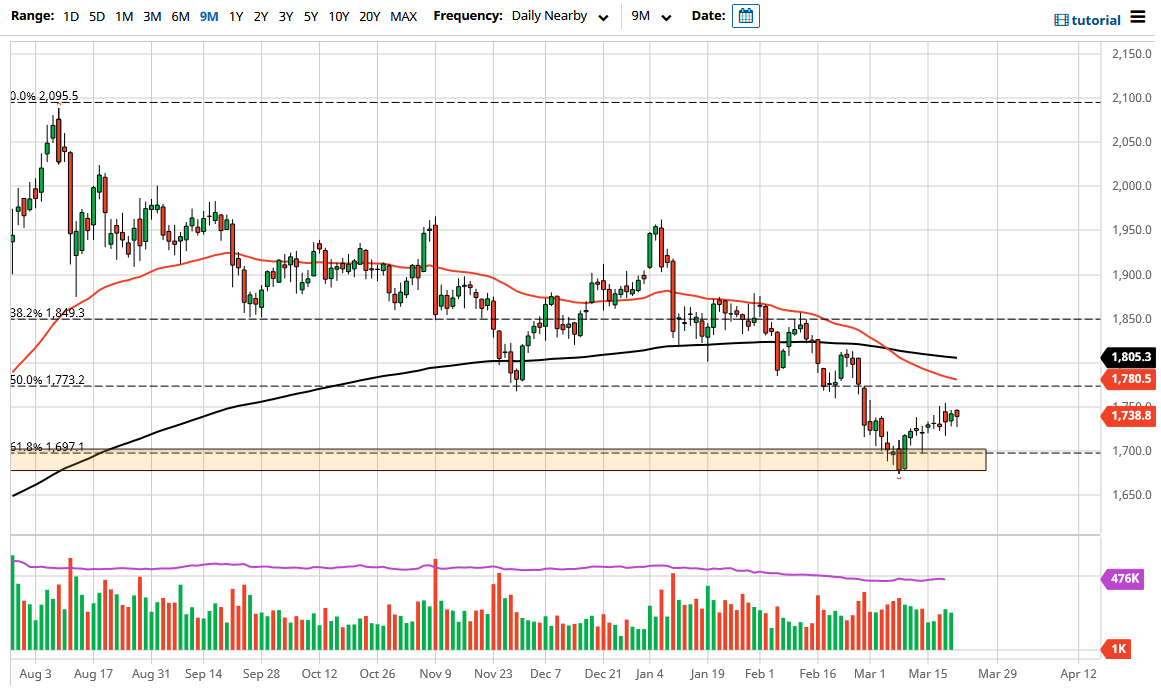

We did see a nice recovery, but we still have not broken above the $1750 level, which is a large, round, psychologically important “midcentury mark”, that a lot of people will pay close attention to. If the market was to break above there, then it would target the 50 day EMA, and then eventually the $1800 level. The $1800 level also features the 200 day EMA, so that will attract quite a bit of attention as well. Gold markets have been rather resilient over the last week or two, but longer-term we are still down roughly 22% or so from the highs.

Underneath, the gold market has plenty of support at the $1700 level, which of course is a large, round, psychologically significant figure and of course an area where we have the 61.8% Fibonacci retracement level. This is a market that is very sensitive to round figures, so it is not a huge surprise that we may have bounced from there. However, if you can see the market break down below the recent lows, that more than likely will open up a major drop down towards the $1500 level underneath which is the next huge support level on the longer-term situation.

This is a market that I think continues to show noisy behavior, but I would not be interested in jumping into this market for a long time until course we get above the 200 day EMA. If we close above there, then the market is likely to go much higher. However, we are not there yet and therefore I think that at this point we still have to look at the market as one that is still very much in a downtrend so this recent bounce could be thought of as a pullback in an otherwise longer-term downtrend.