After the GBP/USD pair abandoned the 1.4000 psychological resistance level, the bears gained control and succeeded in pushing the pair towards the 1.3740 support. The pair settled around the 1.3750 level at the time of writing. The US Federal Reserve, led by Jerome Powell, emphasized that the US economy is in a good position and leading the progress in vaccinations and the introduction of more economic stimulus plans.

The European dismal vaccination progress has added to the support for the US dollar.

Vaccines are important to the pound sterling, which analysts say has benefited from the rapid vaccine introduction in the UK in recent weeks, and in the first half of March, it took the first place as the best performing currency in 2021. But this crown is at risk of slipping due to growing discontent among member states in Eurozone from the bloc's lackluster vaccination program, which they believe is partly due to a lack of supplies from British-Swedish manufacturer AstraZeneca. The solution that many European officials are proposing is to restrict the export of vaccines to the UK and selected other countries.

Accordingly, David Forrester, a Forex strategic analyst at Crédit Agricole, says: “We note the growing importance of the Forex market to any further escalation of post-Brexit tensions or recent concerns about potential disruptions to the implementation of vaccination in the UK. All of these considerations call for a more cautious view of the British pound, especially against the US dollar."

The European Commission and countries such as France and Germany have expressed at various points in recent weeks their desire to prevent the export of vaccines to the United Kingdom in the hope of boosting recovery in the European Union.

Over the past weekend, these calls rose loudly, and there were numerous press reports that the European Council meeting on Thursday will see leaders make a decision on whether or not to stop exports to the UK. Such a development should exacerbate concerns about supplies in the UK, given the warnings issued last week that April was indeed likely to see supplies decline and the program slowing down. Accordingly, Niksch Sujani, an economist at Lloyds Bank, says, "In the near term, the pound is likely to remain driven by developments between the UK and its major vaccine suppliers, especially given reports of a possible slowdown in supplies in the coming weeks."

Reports indicate that British Prime Minister Boris Johnson will try to persuade the Commission and Member States to take such a measure in the coming days, while Irishman Taweisch Michel Martin told Irish station RTÉ that he opposes the European Union imposing a ban on the export of COVID-19 vaccines, describing it as "a step back."

Consequently, the imposition of the ban could slow down the vaccination campaign in the UK, although it is too early to determine precisely the degree. However, from the perspective of the performance of the Forex market, the dispute generates uncertainty, and since the 2016 European Union referendum, the British pound has shown that it is very sensitive to this uncertainty.

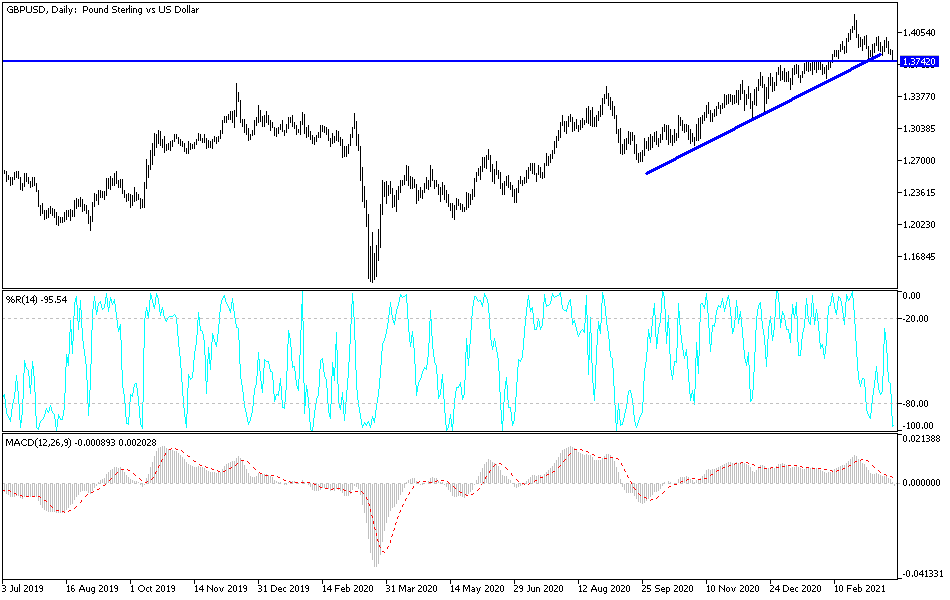

Technical analysis of the pair:

On the daily chart, recent sell-offs pushed the GBP/USD pair and the technical indicators to strong oversold areas. It is expected that Forex traders will think of buying the pair, and I see that the most appropriate support levels at which to do so are 1.3720, 1.3655 and 1.3580. On the upside, the psychological resistance 1.4000 will remain the most important for the return of bullish control over the performance. I still see Britain as a candidate for a rapid economic recovery amid the progress in vaccinations.

From Britain, inflation figures, CPI and PPI readings will be published. Then, the PMI reading for the manufacturing and services sectors will be released. From the United States, the durable goods order numbers will be announced, followed by the second testimony from Federal Reserve Chairman Jerome Powell.