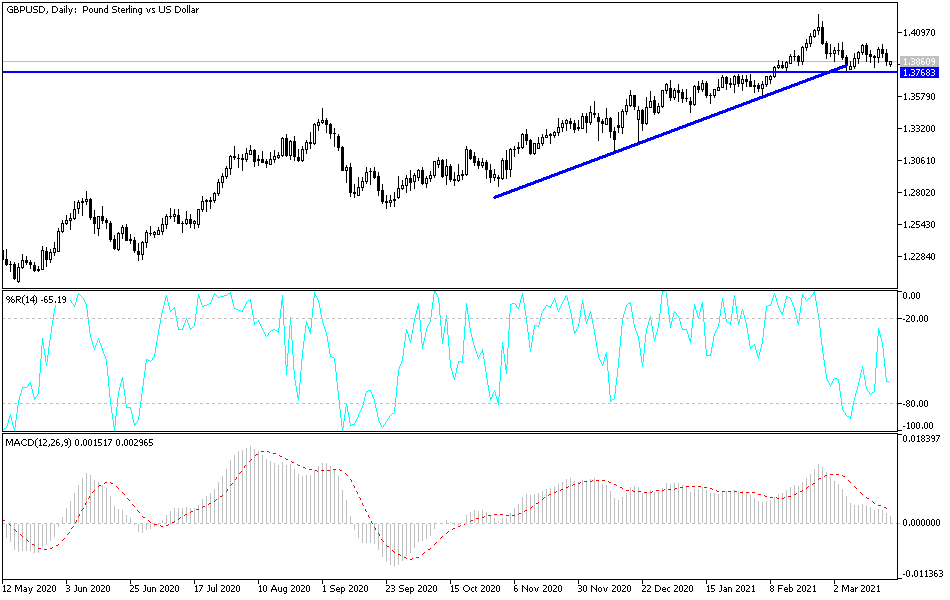

For a short time, the GBP/USD returned to test the 1.4000 psychological resistance level during last week’s trading, but the bears pushed the pair to the 1.3830 support level during Friday’s trading session before closing the week’s trading around the 1.3862 level. A retreat for the GBP/USD below the 1.38 level will push the technical indicators to strong oversold levels, and thus may provide opportunities for buying. The foundations of the pound's gains - namely, the fast pace of vaccinations in the UK - are still intact.

Strong optimism among consumers and businesses is a powerful driver of economic growth, and new surveys show that the UK now has this key component of growth in abundance, which in turn could support the current trend of the sterling's outperformance. The increased optimism about the future could lead to a strong recovery in consumption and business investment in the United Kingdom, allowing the economy to fully recover from the decline of the COVID-19 crisis by the end of 2021, which is much closer than what the leading forecasters had expected.

In this regard, according to the YouGov survey, the British are now more optimistic about the COVID-19 situation than their counterparts in other European countries, while a separate poll by Ipsos MORI shows that Britain has seen a surge in economic optimism. Optimism is generated through the rapid introduction of a vaccine in the country that promises a sustainable and irreversible openness to the economy, allowing consumers and businesses to plan with confidence.

Ipsos MORI's latest political observer reveals that 43% of Brits believe the economy will improve over the next 12 months (up 14 points from last month), 14% say it will remain the same (top 5), while 41% believe it will get worse (down 19), giving an EEI score of +2 (compared to -31 in February).

Bank of England Governor Andrew Bailey said that the UK's economic prospects are improving as a result of the successful vaccine program and that the economy is expected to perform stronger than expected in the coming months. In an interview with BBC Radio 4, Pelly said he now sees "upside risks" to the bank's growth outlook, a development that Forex analysts say will support further gains in the pound.

Bailey also said the economy could now recover to pre-crisis levels by the end of the year.

The British economy will be boosted by a big jump in consumer spending in 2021 as pent-up savings are wiped out according to Deutsche Bank economists, who have also warned that the Bank of England may reduce the size of the impending consumer-led recovery. All in all, an unexpectedly strong economic recovery could in turn push inflation above the Bank of England target of 2.0%, raising market expectations for a future rate hike and supporting the British pound.

Technical analysis of the pair:

The pound has appreciated by just over 3% against the dollar last year, and has risen another 1.5% since the beginning of 2021 until now. This month, the GBP/USD pair tried three times to break above the 1.40 psychological resistance as it did last month, but failed to do so. It has done well since the US election and vaccine in early November. Now the momentum has stalled. Any attempt by bears to break through and stabilize below the 1.3800 support level will be important for Forex investors to consider buying the currency pair. Currently, the closest support levels for the currency pair are 1.3785, 1.3700 and 1.3620. On the upside, a return to move above the 1.40 psychological resistance is important for the bulls to dominate. I still prefer to buy the currency pair from every downside.

Today's currency pair is not expecting any important British economic data, and all the focus is on the US session, which includes statements by US Federal Reserve Chairman Jerome Powell. Then, the number of existing US home sales and statements from a number of US monetary policy officials will be announced.