Risk appetite has calmed down and talk of exaggerated gains for the British pound in the Forex market recently started. What happened in the bond market was also a factor that contributed to the sharp selling of the GBP/USD pair, which reached the 1.3888 support level, down from its highest level in three years. The pair tried to rebound at the beginning of this week's trading, but did not break through the 1.4000 psychological resistance. Therefore, the opportunity was better for the bears again to move down until it reached the 1.3903 support before settling around the 1.3890 level at the beginning of Tuesday's trading.

The bond market losses and higher yields prompted investors to turn away from “carry trade” bets on emerging market currencies and other assets which fell last week, leading to the automatic repurchase of the euro and dollar after being used as a “funding currency” in recent months.

After the recent selling, some analysts believe that what happened is just a correction to the recent sharp upward trend, and that there is still optimism for the GBP/USD pair, as the pound is expected to benefit from the vaccination profits and the Bank of England is less pessimistic, while the Fed is cautious. Leading the extremely negative US real interest rates should also contribute to the GBP/USD's rally. "High US yields have tightened global financial conditions, which is a far cry from welcoming news in Europe and many emerging markets where vaccines and the economic outlook lag behind the US," says Eric Nielsen, Chief Economist at UniCredit Bank.

The pound is awaiting the announcement of the British budget this Wednesday, the details of which may be announced by Finance Minister Rishi Sunak, as he expects to extend support plans such as granted leave until the summer, and speculation indicates that tax increases are possible, although it is not clear that the currency markets object to it. There may be a more important focus on the forthcoming statements of US Federal Reserve Chairman Powell and the announcement of US job numbers.

The pound sterling was at the forefront of the major currencies in expressing the deflationary trade so far in 2021, aided in large part by the tough stance of the Bank of England, which became possible thanks to the rapid vaccine rollout that led economists to expect the United Kingdom to lead the recovery of major economies this year. This comes at a time when many other global central banks are writing down their economic forecasts or are simply too busy trying to dampen the strength of their currencies, so the Bank of England's position is not far from the recommendation to buy the pound sterling. We have seen the BoE becoming increasingly aware of bullish risks to its own inflation target and pushing financial markets to start questioning the likely timing of a first rate hike, no matter how far away, which is what supports the pound.

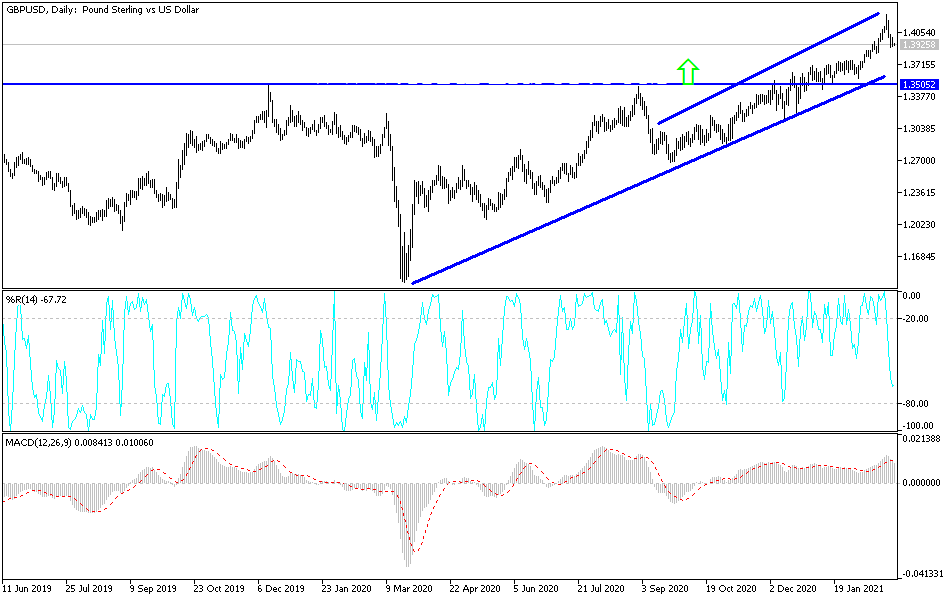

Technical analysis of the pair:

Despite the recent downward correction, the GBP/USD pair is still within a bullish channel on the daily chart, and a breach of that channel may occur if the currency pair moves towards the support levels at 1.3840, 1.3750 and 1.3635. However, the performance on the graph of the four-hour chart shows that technical indicators began to give oversold signals. On the upside, the bulls need to stabilize above the psychological resistance 1.4000 to strengthen the bullish outlook again.

I still prefer to buy the GBP/USD from every dip, especially with a breach of the support at 1.39.

Today's economic calendar:

The economic calendar is devoid of any important data from Britain or the United States of America.