The UK's gradual loosening of COVID-19 restrictions contributed to a cautious recovery of the GBP/USD. Correction attempts pushed the currency pair at the beginning of this week's trading to the 1.3846 resistance level before returning to stability around the 1.3770 level as of this writing. The recent strength of the dollar continues to negatively affect the pound's gains. After a coronavirus lockdown for nearly three months, along with the rapid spread of vaccines that have led to a drastic reduction in infections, England has embarked on a significant relaxation of restrictions with families and friends able to meet outside, and many sports allowed again. The other parts of the United Kingdom - Scotland, Wales and Northern Ireland - are taking largely similar steps.

Overall, the pound's near-term momentum has turned increasingly positive, after recovering during the last part of last week's trading as analysts said that positive sentiment regarding the vaccine-driven economic recovery in the UK remains the main source of support for the currency. But the pound has weakened against the euro and the dollar from mid-March to late March due to concerns that a slowdown in vaccine supplies to the UK will impede the country's vaccination campaign and threaten the roadmap to exit from the lockdown.

Fears about a slowdown in the vaccination drive have ultimately raised questions about what was an important driver of sterling strength according to analysts. But the government remains adamant that increasing the supply of COVID-19 vaccines in the coming months will allow the UK to "ramp up" their rollout.

In this regard, Housing Minister Robert Jenric told Sky News that the United Kingdom will stay in the lead ahead of other countries in launching the vaccine and that the government is "on its way" to achieve its goal of providing a first dose to the nine highest priority groups by April 15 and to all by the end of July. As of Saturday, 30,151,287 people had received their first dose, with 3,527,481 of those having taken a second dose, and are therefore considered fully immune.

It was reported over the weekend that supplies of the Moderna vaccine will start arriving in the country sometime in April, which could allow those in the 40-50 age group to get their first dose of the vaccine. Joe Manembo, Chief Market Analyst at Western Union, said: "The pound sterling has shown initial signs of decline as the UK confirms that it has sufficient supplies of vaccines to vaccinate all adults by August."

So far, analysts believe that the British pound has benefited from the rapid introduction of the vaccine in the United Kingdom in recent weeks, and in the first half of March, the pound was crowned as the best performing currency in 2021. However, this crowning retreated due to threats by the European Union to ban supplies of the vaccine to the United Kingdom.

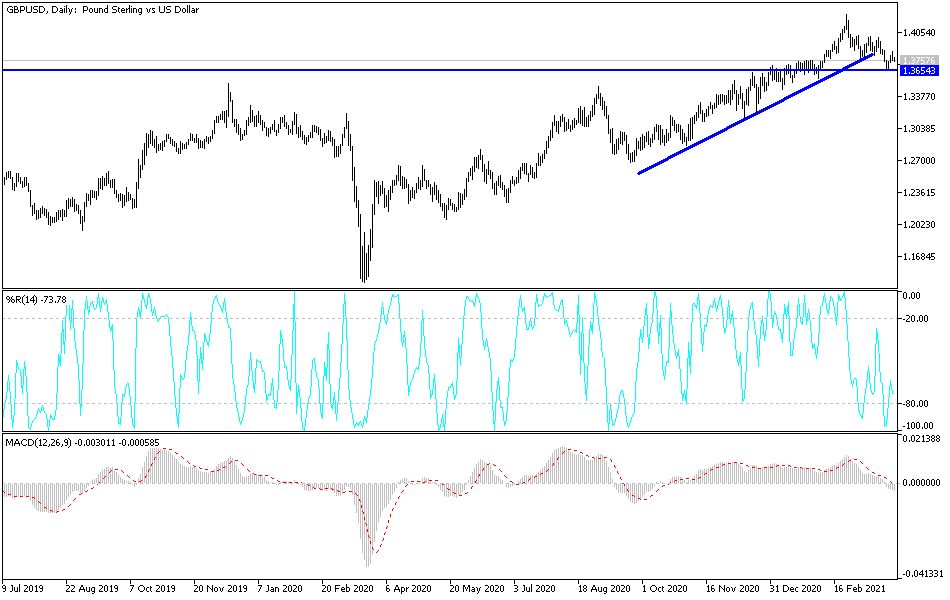

Technical analysis of the pair:

As of now, the bears dominate the performance of the GBP/USD. The bulls will not return to control performance without moving towards the psychological resistance at 1.4000 again. The current closest support levels are 1.3700, 1.3645 and 1.3580. I still prefer to buy the currency pair from every downside.

The factors for the pound's gains are still in place, and the dollar's recovery will not last long. The currency pair will be affected today by the performance of global stock markets and the extent of investor risk appetite, in addition to the announcement of the US Consumer Confidence Index reading.