The British pound has often benefited from gains in global stock markets and Britain's advanced vaccination drive, which fosters hope for a rapid economic recovery. However, for the fourth consecutive week, the GBP/USD currency pair has been subjected to profit-taking after surpassing the 1.4240 resistance, the highest in three years. The recent sell-off pushed it towards the support level at 1.3673 before settling around 1.3700 at the time of writing. Amid the return of weak investor confidence, as COVID infections in Europe are increasing, stock market gains have stopped, and concern about the future of inflation has returned, along with the demand for buying the US dollar as a safe haven.

UK inflation in February was much weaker than analysts had expected, but there remains a consensus among economists that a steady price hike is coming. UK CPI inflation grew by only 0.1% in the month ending in February according to the Office for National Statistics, which was a -0.2% rise in January but well below market estimates of 0.5%. Until February, prices were up 0.4%, lower than the January reading of 0.7% and the consensus forecast of 0.8%.

Lower-than-expected inflation readings cause a headache for the Bank of England. The bank is expected to consider pursuing lower interest rates and more quantitative easing, both of which will typically affect UK bond yields and the British pound.

But the Office for National Statistics says the February inflation deficit could be largely due to the decline in the apparel retail sector, as this indicator could be temporary and ultimately unlikely to bother policymakers at the Bank of England. Economists say the UK economy will be boosted by a big jump in consumer spending in 2021 as the pent-up savings accumulated during the crisis have been eliminated, prompting economists at Deutsche Bank to warn that the Bank of England may reduce the size of an imminent recovery to lead the consumer.

A Deutsche Bank analysis released this week shows that the boost to UK economic growth from savings spending could reach 1.0% of GDP, more than double what the Bank of England had forecast. An unexpectedly strong economic recovery could in turn push inflation significantly above the BoE target of 2.0%.

ING, for its part, says they expect UK inflation to jump from April onwards thanks to higher energy prices, partly because we will not be comparing gasoline prices to pre-epidemic levels, but also because the household energy price ceiling will rise to 9%. Also, Paul Dales, UK Chief Economist at Capital Economics, says the energy effects will have a much bigger upward impact on inflation when the level of fuel prices in April is compared to the low it reached in April.

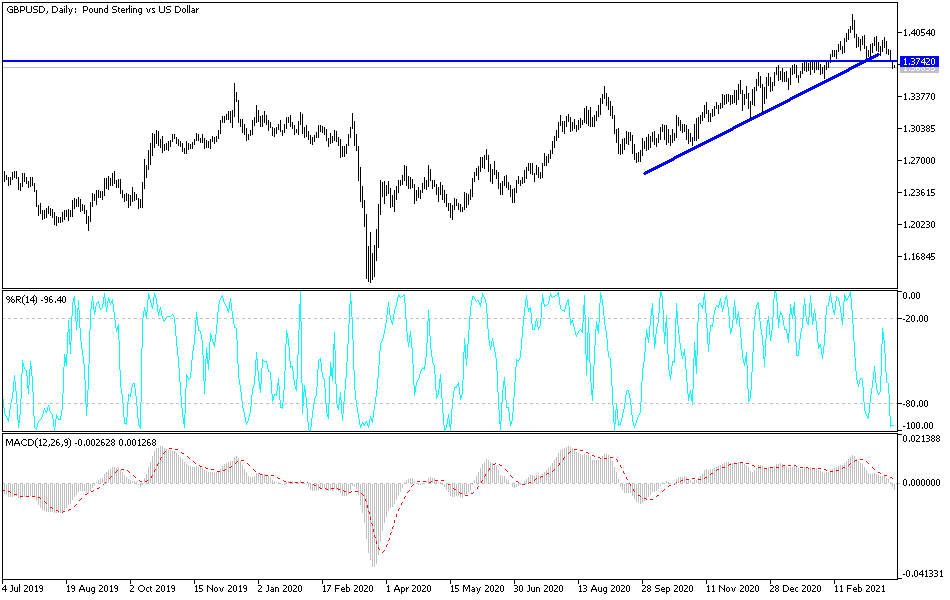

Technical analysis of the pair:

On the daily chart, the recent profit-taking of the GBP/USD pushed the technical indicators to strong oversold levels, so I expect a rebound from here. The most appropriate buying levels for the currency pair are 1.3655, 1.3580 and 1.3490. On the upside, the currency pair will not return to its strong bullish path without crossing the psychological resistance of 1.4000 again. I still prefer to buy the pair from every downside. The sterling gains factors are still in place and the recent correction is natural.

There will be new statements from the governor of the Bank of England. During the US session, the weekly US GDP growth rate and jobless claims will be announced.