Last Monday’s GBP/USD signals were not triggered, as none of the key support and resistance levels identified were reached that day.

Today’s GBP/USD Signals

Risk 0.75%.

Trades must be entered before 5pm London time today only.

Short Trade Ideas

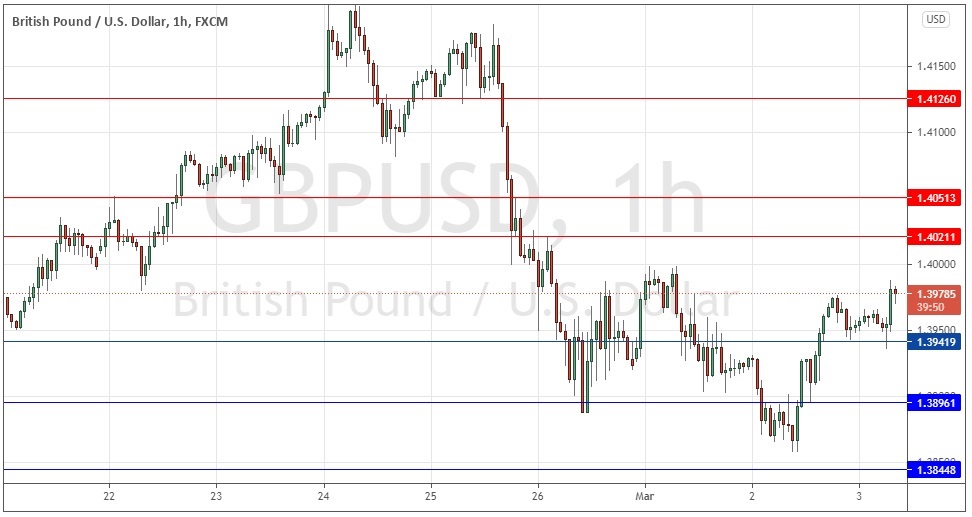

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4021, 1.4051, or 1.4126.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3942, 1.3896, 1.3845.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote last Monday that at a push, I preferred short to long trades, but I thought that the price was just going to trade sideways between 1.4000 and 1.3900 over the coming hours of that day’s London session.

This was an excellent call, as the price made a bearish consolidation within that specified range between the round numbers.

Today is likely to be a significant day for the British pound, as the British government will be releasing the details of its new annual budget. This typically causes volatility in the price of the pound as the market digests what the measures might mean for the British economy.

Technically, although the price chart shows lower lows and lower highs since 24th February, the picture seems to have become less bearish, although there is strong selling from the 1.4000 area which may continue. However, we have just seen new higher support at 1.3942 hold up quite firmly, so it is starting to look as if the bulls will be able to push the price up to at least 1.4000 today.

I think the best course of action with this currency pair today will probably be to stand aside until after the budget release and then try to trade a reversal at any key support or resistance level – the further away from the 1.3975 area, the better.

Regarding the GBP, there will be a release of the British government’s budget at approximately noon London time. There is nothing of high importance concerning the USD scheduled for today.