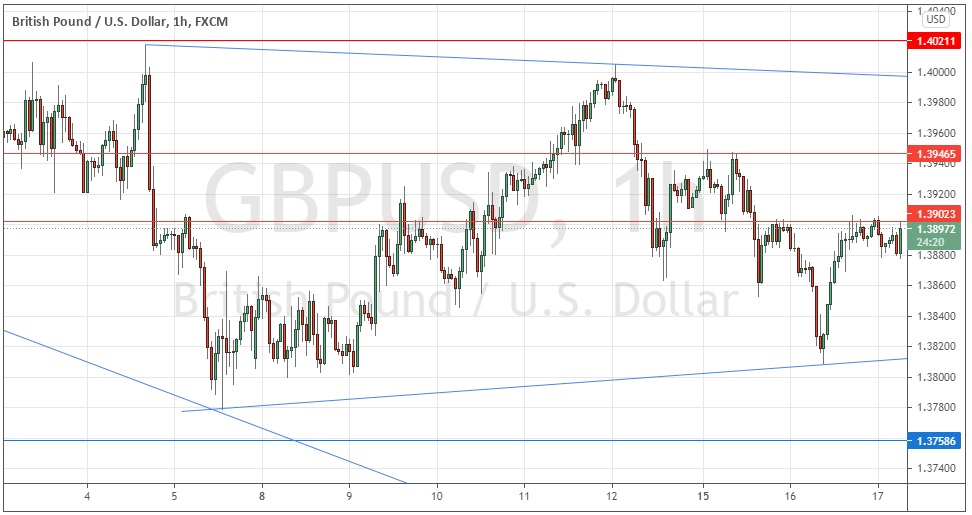

Last Monday’s GBP/USD signals were not triggered as unfortunately the bearish price action took place a few pips above the resistance level identified at 1.3938 and the bullish bounce at the support level of 1.3855 did not happen until the London session was ending.

Today’s GBP/USD Signals

Risk 0.75%.

Trades must only be taken between 8am and 5pm London time today.

Short Trade Ideas

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3902 or 1.3947.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the ascending trend line shown in the price below sitting at about 1.3815 or 1.3759.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote last Monday that I expected the price to consolidate over that day between 1.3855 and 1.3938 so was ready to trade reversals from these levels. I did not expect either of these trades to run very far into profit so thought it wise to manage any trade on a short time frame.

This was a good, accurate call as the price did basically remain within these boundaries over Monday’s London session.

The technical picture now is one of a medium-term narrowing consolidation between 1.3800 and 1.4000, as evidenced by the narrowing trend lines shown in the price chart below. Over the shorter term, the picture remains bearish while the price is held down by the resistance level at 1.3902, which is currently under serious threat.

I think the two key levels to watch today will be 1.3902 and 1.3947 – if either one is broken and the price holds above it for a couple of hours, that will be a bullish sign, although it would be wise not to expect a lot of price movement until the FOMC release later. Regarding the USD, there will be a release of the FOMC statement, rate, and economic projections at 6pm London time followed by the usual press conference half an hour later. There is nothing of high importance scheduled today concerning the GBP.

Regarding the USD, there will be a release of the FOMC statement, rate, and economic projections at 6pm London time followed by the usual press conference half an hour later. There is nothing of high importance scheduled today concerning the GBP.