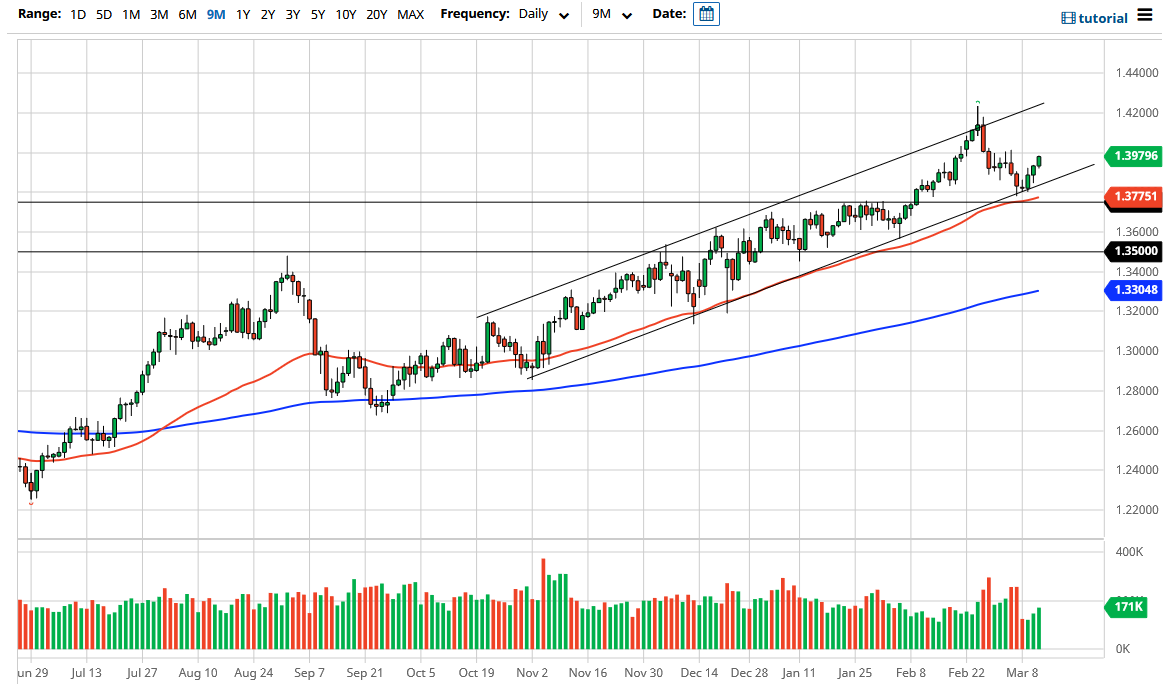

The British pound has rallied again during the trading session on Thursday as it now looks as if we are threatening the 1.40 level. We have recently bounced from the bottom of an overall channel and have shown the 1.3750 level to be crucial. At this point time, it is likely that the market is ready to try to get towards 1.42 level above which is the weekly resistance barrier, and it suggests that we could try to break out for a bigger move given enough time.

All of that being said, it does not necessarily mean that we are not going to get a short-term pullback, but I think that the uptrend line of the uptrend channel is going to continue to offer dynamic support. The 50 day EMA sits just below there as well, so I do think at that point there be even more buying pressure. We have been in an uptrend for quite some time, and there is no reason to think that is going to change anytime soon. With all that being said, I have two potential setups that I am looking at right now, both of which are bullish.

If we get a daily close above the 1.40 level, then I think we go looking towards 1.42 handle. On the other hand, if we pull back then I am looking for some type of supportive candlestick on a lower timeframe to get involved yet again. I think this market has to make another move towards 1.42 handle, as it looks very important from a longer-term standpoint, and therefore to think that we would have sliced through it in one move probably was asking quite a bit. Pulling back the way we have to build up the necessary momentum makes quite a bit of sense and it is quite common. You will notice that there are several wicks from last week at the 1.40 level, and that for me tells the story that there is a lot of resistance in that area. If we can blow through there, then we should see a little bit of a “air pocket” to the upside. All things being equal, I do not have a scenario in which I am a seller anytime soon, as the British pound has been favored for quite some time, and it still technically cheap from historical standpoint.