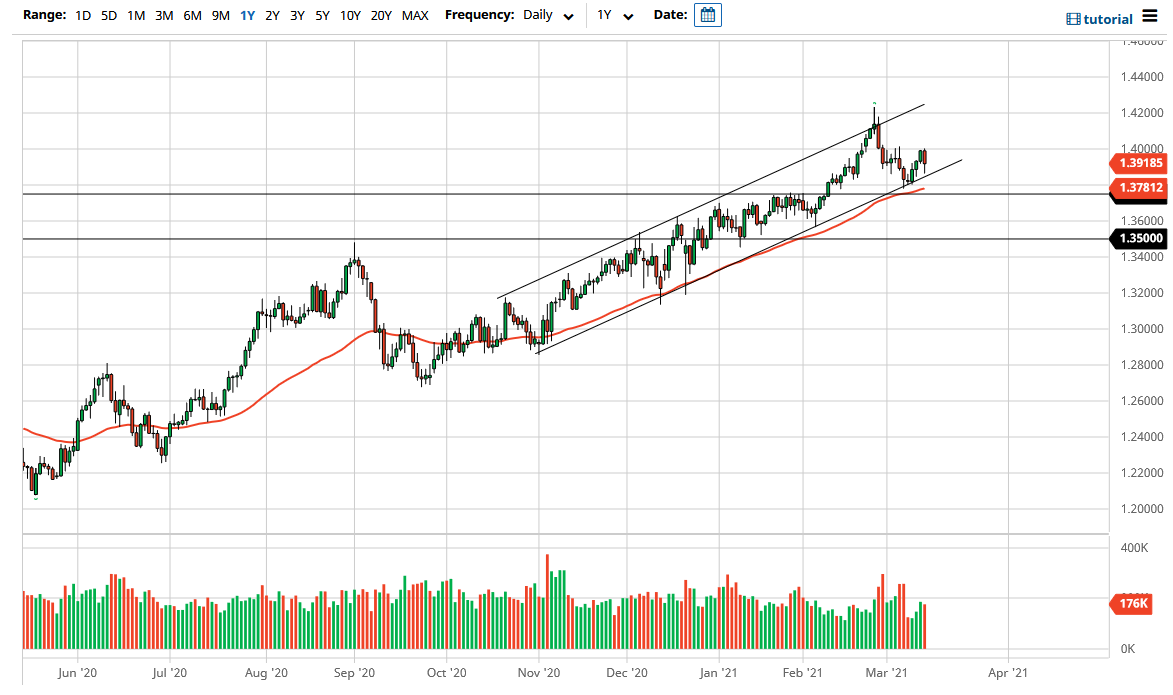

The British pound has fallen most of the trading session on Friday but continues to see support at the uptrend line that makes up the bottom of the up trending channel. At this point, the 1.40 level continues offer resistance, and shaping the candlestick highs for the day and then turning around to reach towards that area suggests that we are going to eventually find buyers to push this market to the upside. If we can break above that 1.40 level, then it is likely that the market goes looking towards the 1.42 handle. That is an area that I think will take a significant amount of momentum to break through, as it is massive resistance on the weekly timeframe.

All things been equal, this is a market that I think continues to see a lot of support underneath that uptrend line, not only due to the line itself but the fact that we have bounced from just underneath there, and of course the 50 day EMA that sits just below there. After that, we then have the 1.3750 level, an area that has been important more than once and therefore I think it is likely that we are going to continue to see buyers in that general vicinity, and therefore I think that given enough time traders continue to come in and “pick up value on dips.”

I think in general, the market will continue to be very noisy, so having said that I think that you need to look more towards the short-term charts than anything else, using the daily channel as a bit of a guidepost. I have no interest in shorting this market, at least not until we break down below the 1.35 handle underneath, which is a massive round figure that a lot of people would be paying close attention to, so at that point I would start shorting. In general, I think that this is a market that continues to show quite a bit of momentum in this general vicinity, so with that being said I like the idea of buying on short-term support candles. If we can break above the 1.42 handle, then we could really get moving to the upside, but it is very unlikely that we will see that happen anytime soon. Ultimately, I believe that this is a market that will be noisy but more or less chopping to the upside.