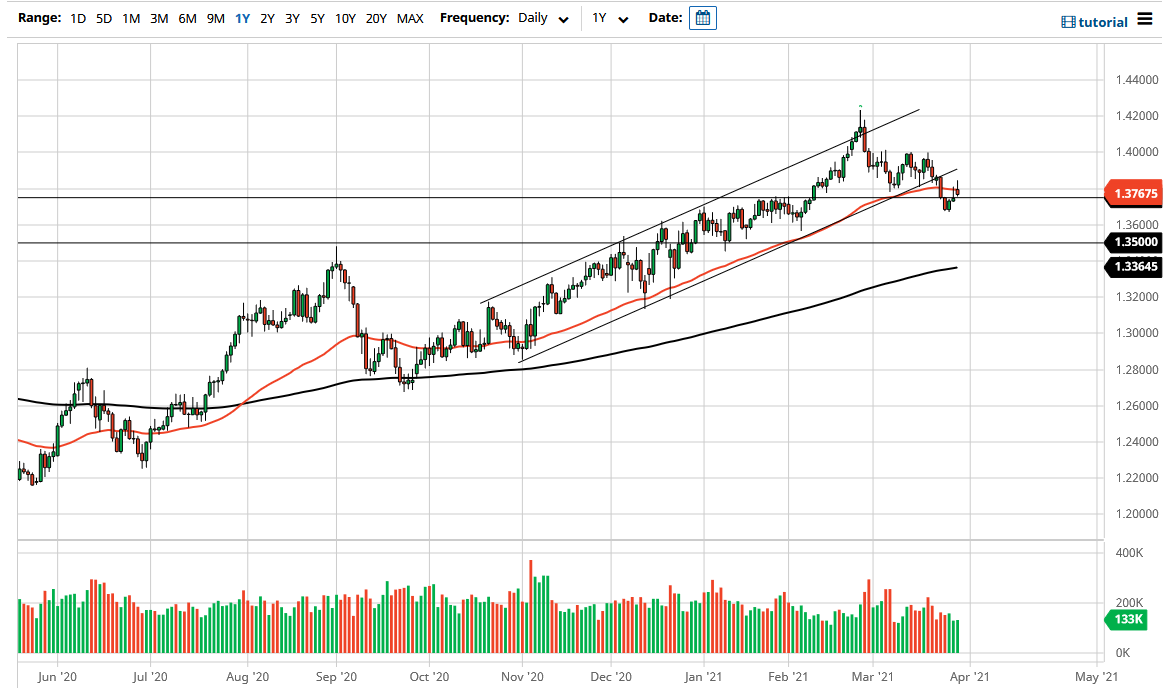

The British pound has initially tried to rally during the trading session on Monday but gave back the gains once we got above the 50 day EMA and a sign of weakness. The daily candlestick is somewhat of a shooting star for the second day in a row, and that of course is not a good look. Nonetheless, there is plenty of support underneath that extends from the 1.3750 level all the way down to the 1.35 level underneath.

If we were to break down below the 1.35 handle, then it would be an extraordinarily negative turn of events, as we would then test the 200 day EMA. The 200 day EMA of course is an area that attracts a lot of attention, but at this point the question is more or less whether or not the US dollar is going to continue to show strength across-the-board. After all, the US dollar will continue to get a bit of a boost if there is more of a “risk off” type of attitude.

With that being the case, I think that we are very likely to continue drifting lower. I do not necessarily believe that you should be selling the British pound, but the US dollar will probably strengthen against multiple currencies around the world, not just the Euro. After all, we are seeing the Australian dollar and the New Zealand dollar both struggle against the greenback as well. The British pound has been a bit of an anomaly as of late, and it is rather historically cheap at these prices.

The Biden administration decided to target the United Kingdom during the day in a spat when it comes to technology, but at this point in time there are no Terrace even though they were threatened. It seems a bit hard to believe that the United States in the United Kingdom would enter a trade war, but here we are. That being said, I think that this is more correction than anything else, so I am not looking for a bigger move. On the other hand, if we were to turn around a break above the top of the candlestick for the trading session on Monday, I think that would be very bullish and we would more than likely go looking towards the 1.40 level above.