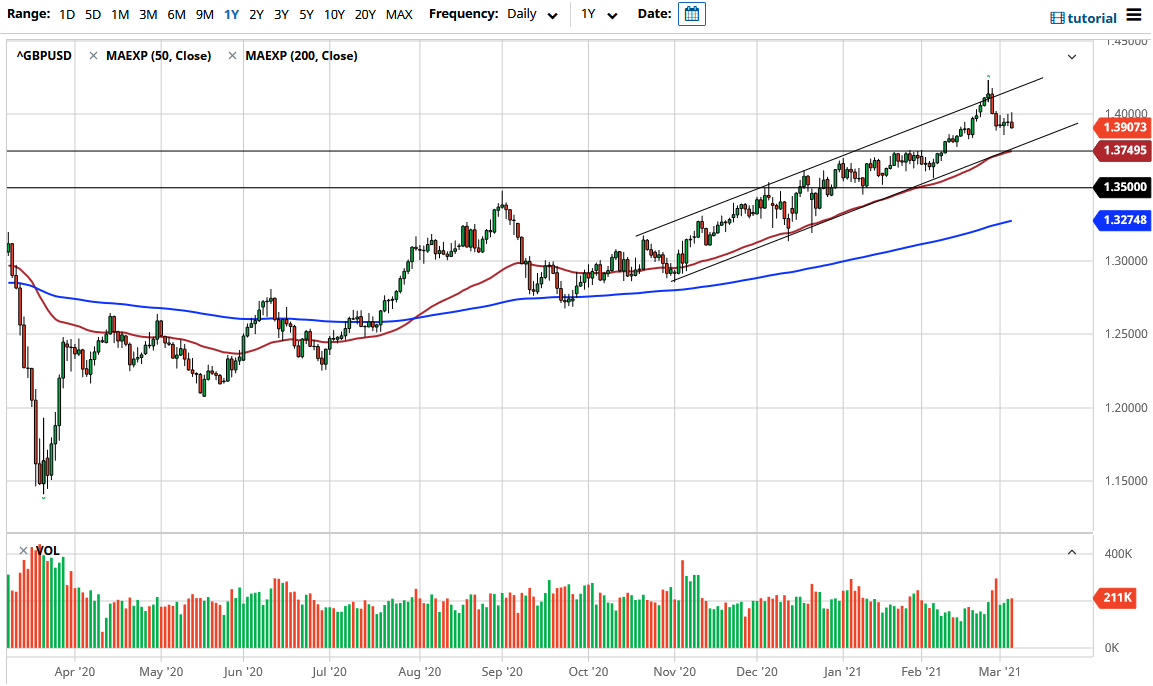

The British pound initially tried to break above the 1.40 level during the trading session on Thursday but pulled back from that major figure as we continue to see a bit of resistance in that general vicinity. The 1.40 level is an area that continues to be a bit of a thorn in the sign but at this point in time if we can break above there the market then goes looking towards the 1.42 handle. The 1.42 level is a weekly resistance barrier that the market has pulled back from rather significantly, forming a shooting star last week. At this point though, it is very likely that the market is going to find buyers underneath and therefore trying to rally again.

I am especially interested in the 1.3750 level, an area that was previous resistance and now should be support. Furthermore, the 50 day EMA is walking right along the uptrend line from the channel, so I think all things being equal we will find buyers sooner rather than later. That being said, Jerome Powell did not deliver anything in his speech during the trading session on Thursday that had people buying the US dollar as people are worried about the interest rates spiking even higher.

The shape of the candlestick is a bit of a shooting star but quite frankly I think that the market will continue to see plenty of interest underneath because we have been in a huge uptrend for some time and quite frankly I do not feel like fighting it. The British pound of course has been rallying due to the United Kingdom coming out of a major lock down, and of course we have also seen the British vaccinate more of their population than many of their peers. All things been equal, the market looks very likely to see a lot of back and forth, but it is going to be especially interesting due to the fact that the jobs number is coming out on Friday. I am looking to buy a dip, but we will have to see whether or not we can get back to that crucial 1.3750 area in the meantime. On the other hand, we could turn right around and break above the 1.40 level, which would open up a move back to the 1.42 level again.