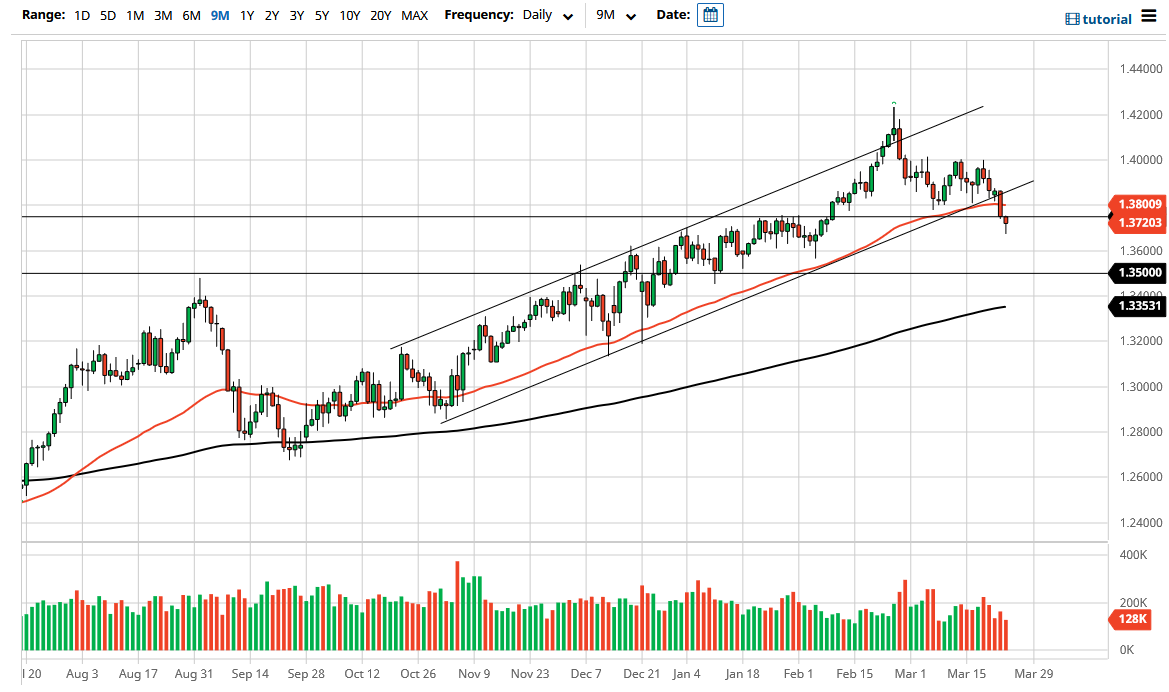

The British pound has broken a bit to the downside on Wednesday to pierce the initial support at 1.3750. All things being equal, that is an area that should be important due to the fact that it was the scene of a recent break out, and as a result it is likely that we would see buyers jumping into that marketplace. Now that we have dropped below there and then bounced a bit, the question is whether or not we can continue to break above the crucial level again?

On the other hand, if the market were to break down below the bottom of the candlestick for the trading session on Wednesday, that opens up the possibility of a move down to the 1.35 handle. That is an area that is a large, round, psychologically significant figure, and of course will attract a lot of headlines. All things being equal, the market is going to find a lot of support in that general vicinity, especially as the 200 day EMA approaches that area. I do not necessarily think that it is going to be easy to short this market, but if we do continue to drift lower, I would be a seller of the British pound against other currencies, not necessarily the US dollar.

In the other hand, if we did turn around in recapture the 50 day EMA above, then it is very likely that the market goes looking towards the 1.40 handle, which is a large, round, psychologically significant figure that people will be paying close attention to as it is a major resistance barrier. Breaking above that level would open up a move towards the 1.42 handle, which is a longer-term weekly resistance barrier that a lot of people will be paying close attention to. If we can break above there, then the market is likely to go looking towards the 1.45 handle. All things considered; this is a pair that had gotten far ahead of itself, so I think that it is only a matter of time before value hunters come back in based upon the overall trend. However, one of the things that the US dollar has been reacting to as of late has been yields, as we have seen the treasury market selloff. At this point, it is very interesting to see where we go from now, as we are stuck in a major support band. I am relatively neutral in the short term but a break at this candlestick in one direction or the other leads my next trade going forward.